It is difficult to know if the idea of a bank having

a network of branch offices was an original Scottish idea. What is

certain is that Scotland was the first country to develop a series of

banks with branches.

The idea was present in Scotland from the beginning.

Shortly after its formation in 1695 the Bank of Scotland opened branches

in Aberdeen, Montrose, Dundee and Glasgow but it was a difficult time

for Scotland with a series of bad harvests and the collapse of the

Darien scheme. The branches were soon withdrawn but the idea was not

forgotten. The formation of the Royal Bank in 1727 presented a range of

competitive challenges to the Bank of Scotland to which it responded by

again trying to set up a small branch network. In the 1730s branches

were set up in Glasgow, Aberdeen and Dundee but again the experiment was

unsuccessful and the branches were closed.

Credit for the first successful branch system must go

to the British Linen Company which was set up by Royal Charter with

powers to foster the linen industry in Scotland. These powers also

included the right to engage in banking and by the 1760s the company had

an extensive banking interest. It had established agents, about ten of

them, in various parts of Scotland and some of these carried on business

as bankers as well as linen agents. It is this dual role of many of the

early branch bankers which makes it impossible to unravel all their

activities and to offer a judgement on whether these men were primarily

bankers or if their other interests were their major activity. Some of

the provincial banking companies also had branches in the 1760s but

again it is not possible to be certain about the nature and types of

business being carried out.

The success achieved by other banks in the 1760s

moved the Bank of Scotland and Royal Bank to try to control them first

by setting up a note exchange and then by setting up branches to compete

actively with them. The two Edinburgh banks appear to have established

an agreement on this for the Royal Bank opened an office in Glasgow in

1783 while the Bank of Scotland opened several branches in other parts

of Scotland, e.g., Dumfries, Kelso, Kilmarnock, Inverness, Ayr

and Stirling by 1780. In some of these the branch came into direct

competition with the office of a provincial bank. This policy of branch

extension was very successful for the two banks coming, as it did, at a

time of unprecedented expansion in the economy. The branches meant that

the banks were in a competitive position to supply the demand for credit

and so expand their note issues. Before long the Royal Bank's Glasgow

office was doing more business than the head office in Edinburgh and the

Bank of Scotland's network had been so successful that it was extended

to twenty offices by 1810 (including one in Glasgow for its seems that

the territorial agreement between the Edinburgh banks had broken down).

The existence of the note exchange and the branch

systems in competition with provincial banks involved Scotland in a

highly fluid system. It quite often happened that some of the customers

of a provincial bank, dissatisfied with the services of that bank would

petition one or other of the Edinburgh banks to establish a branch in

their town. These men, if successful in their petition, would then

become the main caucus of customers of the new branch. Similarly the

customers of a branch might be dissatisfied and decide to set up their

own provincial bank and perhaps establish a few branches of their own in

satellite towns.

One of the major problems involved in setting up a

branch was in finding the right people to staff it. Unlike today when

branches are staffed by salaried personnel appointed by head office the

practice in the 18th and early 19th centuries was to appoint some local

businessman as agent to run the branch. In this way David Dale,

prominent Glasgow merchant and manufacturer, was appointed joint agent

of the Royal Bank's Glasgow branch and David "King" Staig was appointed

agent for the Bank of Scotland in Dumfries. He was at one time provost

of the town and a very powerful businessman with extensive contacts and

political influence.

Generally the men selected as agents were:

"tried men of business, who have proved, by the

manner of conducting their own affairs, their capability of

successfully transacting whatever may be confided to them." (Thomas

Joplin)

Many of the agents were writers (lawyers), e.g.,

Wm Craig, writer in Galashiels, was agent for the Leith Banking Co.

and was popularly known as "God's Lawyer" because he arbitrated in

disputes between townspeople. Bank directors were usually careful to

pick only men of the highest integrity.

Agents were normally free to continue their other

business interests after their appointment. They were usually paid a

commission on the amount of business done by them and out of this they

had to pay their clerks and offset any bad debts which they might have

incurred. In other words the post of agent might not be all that

lucrative in itself but the appointment was sought because:

"it gives influence to the agent in the town; it

promotes his own business if in trade; and, if a writer or attorney

he makes it pay him as a notary and solicitor, when it may not do so

as a bank agent." (Hugh Watt)

Branch agents would receive parcels of bank notes

from head office which they used to discount bills which, if inland or

foreign bills, they might then remit to head office for collection. Some

branches also operated cash credits and accepted deposits.

The position of trust in which agents stood in

relation to their bank was, to some extent, covered by a bond of

fidelity signed by the agent and his guarantors. To increase the

security, however, banks began to appoint Inspectors of Branches who

travelled the country checking cash balances, bills and vouchers in the

custody of the agents. The Bank of Scotland began this in 1801 but other

banks soon followed suit. Some provincial banks merely sent round two of

their directors but where the branch network was extensive a more

permanent solution to the need for inspection was found in the

appointment of an inspector and, as the system grew, in the appointment

of Inspection Departments.

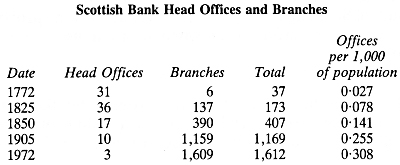

The great growth in the branch system really came

after 1830 with the development of the joint-stock banks although by

that time the density of bank offices (per head of population) was

already much higher in Scotland than in any other part of the United

Kingdom. The figures, so far as they are available are given below.

As can be seen from the table the development of

joint-stock banks after 1830 was very firmly based on the extension of

branches. But this enormous growth in the number of offices reflects the

industrial and urban changes of the times. The. development of

industrial towns in the 19th century and the growth of suburbia and new

towns in the 20th century created great opportunities for the banks to

extend their branch networks.

Yet this growth in the number of offices conceals

certain qualitative changes which were, if anything, even more

significant than the growth in numbers. First among these changes was

the gradual replacement of agents by salaried managers (rather

confusingly the terms were used interchangeably for many years). As

places like Perth and Stirling, which were quite small towns in the 19th

century, had branches of five or six banks it became increasingly

difficult for banks to find men of the right calibre, from amongst the

business population of these towns, who were willing and able to run the

expense and risks associated with being a bank agent. Various compromise

arrangements were tried but ultimately the only possible solution in the

long run was for the banks to appoint people from the head office staff

to become bank managers. In this way a new career path was opened for

people who entered the service of a bank as clerks and could then

expect, in the fullness of time, to be appointed manager of a branch.

More than this, the clerks in a branch were increasingly appointed by

head office and they too could expect to enter upon the promotion

structure. It still happened that managers could be appointed from

outside the bank but this very soon came to be the exception rather than

the rule.

The proliferation of branches in Scotland and the

erection and extension of joint-stock on the Scottish model throughout

the British Isles created a substantial demand for Scottish trained

bankers. The result was a scarcity of experienced men and this had the

effect of increasing salaries in an effort to retain the services of

staff. It can also be argued that the promotion structure in branches

was also opened up to create opportunities for staff and so to retain

their services.

A corollary of these developments was an increase in

the numbers of staff in a branch. In the very early days a branch might

be run by an agent and a clerk but by the second half of the 19th

century the amount of business conducted in a branch was such that a

manager, teller and two clerks was the norm. By the late 20th century

however, such had been the extension of the volume and range of business

conducted by a branch that the average branch staff numbered nine to

twelve although there were great variations on either side of this mean.

The other great changes which had taken place in the second half of the

20th century were in the age and sex composition of the bank's staff.

Female employees were almost unheard of up to 1900

but the effects of two world wars together with more general changes in

attitudes to women in employment have resulted in an employment

structure in which the majority of employees are female. The majority of

bank staff are now also very young. A bank training is considered a

useful background by many employers with the result that bank trainees

with a few years service have often been lured away to other employment

leaving the banks to recruit school leavers to fill the gaps. The

long-term effects of recession, amalgamation and the introduction of

labour-saving data-processing machinery, however, may be to reduce the

preponderance of young people and females.

Counting the number of branches is less of a problem

now than it was in the 19th century. In the early days banks often sent

a director or a clerk to transact business at agricultural fairs or

markets and in the early 19th century the Leith Banking Company had a

tent which it pitched at these markets and in which it extended

hospitality to customers before conducting business. (This kind of thing

still goes on although the office is now usually a caravan rather than a

tent.)

Also banks might open an office on only one or two

days per week. This would operate as a sub-branch although many

sub-branches graduated to full branch status. Services of this kind were

begun— mostly in factories and in market towns in the 19th century and

now extend to hospitals, colleges and anywhere that there are large

groups of people.

Similarly in order to provide a service to customers

in the remoter areas of the Highlands and Islands; from the late 1940s

vans were used by the Clydesdale and Royal Banks to take banking

services to people in these areas and in the 1960s and 1970s these

services were extended to boats and planes, by which time all the banks

were involved.

The existence of sub-branches and mobile branches

makes the analysis of the actual number of offices rather difficult.

Once allowance is made for these difficulties, however, it is clear that

the density of offices is still greater in Scotland than it is in other

parts of the United Kingdom.

Offices of the Scottish banks were until lately

largely confined to Scotland. There seems to have been an understanding

between Scottish and English banks in the 19th century that they would

not cross the border in their branch extensions. But in the 1860s and

1870s the Scots ignored this tacit agreement and opened offices in

London at the same time promising that they would not extend their

branch networks through the rest of England—they were already prevented

by law from issuing their notes in England. Their move into the London

money market, however, was designed to economise on the use of English

banks as London agents. Any bank conducting business in the British

Isles was compelled to manage and settle an increasing number of its

transactions in London which was fast becoming the commercial and

financial capital of the world. The system which had developed was for

the Scottish banks to have a London bank as agent to settle its business

but this proved to be rather inconvenient and expensive. The movement of

the Scottish banks into London provoked the wrath of the English bankers

who excluded the Scots from their Clearing House and did not invite them

to join until 1973—the Scots then declined the invitation.

In the 1970s the English banks set up a few branches

in major Scottish cities ostensibly to service their customers who were

already in Scotland but these have only been moderately successful. It

does not appear that the English banks contemplate a large scale

movement into Scotland. The nature of this development, however, led the

Scots to re-think their attitude to English banking. For a century they

contented themselves with their London offices and a very few offices in

the north of England. Given that the Clydesdale Bank is owned by the

Midland, it would not be reasonable to expect this concern to set up

elsewhere in England, but the Bank of Scotland set up branches in

Birmingham and Bristol, and announced that others would follow. The

Royal, despite its ownership of an English clearing bank, also decided,

in 1982, to set up further branches in England, having already opened in

Carlisle in 1977.

The attention of the Scottish bankers, however, has

not been confined to England. The development of North Sea oil in

particular has encouraged Scottish bankers to develop further their

international business. They began cautiously by opening representative

offices in various parts of the world—notably the oil producing areas of

America and several of these offices have since been upgraded to full

branch status although their raison d'etre will continue to be

corporate rather than personal customers.

The logic of branch banking has always been dictated

by the nature of the demand for banking services. In the 18th century

the demand was for credit and branches were set up to extend credit by

issuing notes. In the early 19th century however, this began to change

as deposit banking became more important than note issuing and as the

nature of the economy changed from being relatively homogeneous to being

highly concentrated with heavy industry in particular focusing its

activities in west-central Scotland and the Tayside Region. The result

of these developments in industry was that the greatest demand for

credit shifted to the regions where there was the greatest concentration

of industry. But savings (i.e., deposits) in these areas were not

sufficient to supply the demand for credit so banks had to raise

deposits elsewhere and the extension of branch networks on a national

scale served this need. The branches served to transfer deposits from

net savings areas in the country to net borrowing areas. The system has

sometimes been criticised for this, it being argued that the saving

areas were thereby deprived of funds which might otherwise be used for

their development. This argument, however, has never been satisfactorily

proven because its proponents have never been able to show that there

was any unsatisfied demand for credit in the areas from which funds were

being removed.

In general we must conclude that the branch system

has been successful in inducing growth in the economy by enabling the

banks substantially to increase their deposit base and to transfer funds

easily from where they are saved to where they are needed to finance

development. Moreover the branch system has been highly successful in

adding fluidity to the payments mechanism not just within Scotland but

throughout the British Isles and indeed throughout the world.