|

THE fifth anniversary of the Scottish Widows'

Fund, 1st January 1820, may be taken as the true turning-point in its

fortunes. Down to near the close of 1819 there had been progress —sure,

indeed, owing to the caution in avoiding anything of the character of

undue risk, and to Patrick Cockburn's vigilance in guarding the funds

against inroads for current expenditure, but disappointingly slow.

Among the influences holding Scottish people aloof

from life insurance must be reckoned the strict character of the national

religion. Evidence of that influence may be found in the address of the

Rev. John M'Laren, D.D., of Larbert and Dunipace, who, as an extraordinary

director, presided over the Eighty-first Annual General Court, in May

1895. "To you who are listening to me," he

said, "it will appear well-nigh incredible that at the time when our

Society was founded, aye, and for many years afterwards, there were people

who looked upon it as wrong—almost sinful—for a man to attach himself to

such an association. When I was presented to the Church of Larbert

forty-eight years ago [1847], I thought it would be a prudent thing to

insure my life, mainly because, being very young, the annual premium would

not be a heavy burden. Before adventuring on the step, I thought it right

to ask the advice of a venerable friend, held in high esteem by all who

knew him for his sagacity and longheadedness. He heard what I proposed to

do, and to my astonishment replied that he had not felt justified in

joining any Insurance Company, because he regarded the doing so as nothing

better than a species of gambling—gambling on the probabilities of life. .

. . I met some other worthy men who were of the same mind, who would have

shrunk as sternly from counselling their sons to take out a policy of

insurance as any prudent father among ourselves would from encouraging his

son to visit the tables of Homburg or Monte Carlo."

If this feeling prevailed among serious persons in

1847, we may be sure that it was even more general in 1819, when the

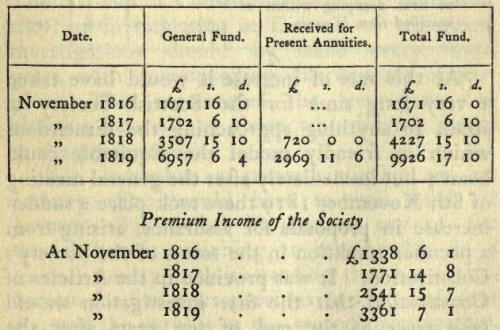

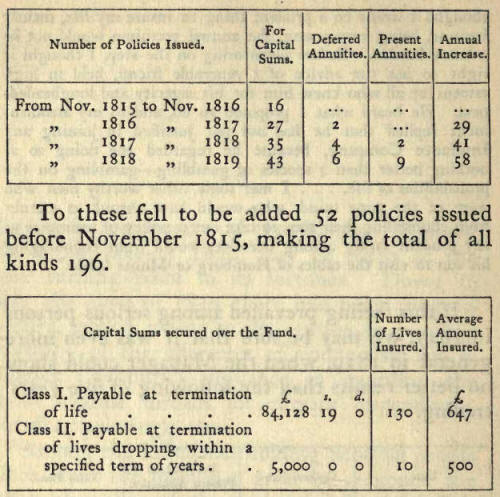

Manager could show no better results than the following of five years'

trading.

At this rate of increase it would have taken a very

long time for the Scottish Society to attain to anything approaching the

dimensions which its friendly model the Equitable could boast; but

immediately after the general meeting of 8th November 1819 there took

place a sudden increase in proposals for assurance, arising from a

peculiar condition in the terms of the Society's Constitution. It was

provided in the Articles of Constitution that the first investigation

should take place at the end of ten years after the formation of the

Society, and that two-thirds of the surplus fund that might then be

ascertained should be allocated among such of the members as had accepted

policies of assurance more than five years previous to such investigation.

Hence, at the investigation to be held as on 1st January 1825, no members

would share in the divisible surplus who had not effected insurance before

31st December 1819.

This consideration

seems to have been enough to accelerate the action of those who were

contemplating insurance, and to cause them to join the Society in time to

entitle them to share in the bonus distribution five years hence; which

may be held to account for the sudden access of numbers during the closing

months of 1819.

But the matter was not

allowed to rest there. The Articles of Constitution provided that, after

the first investigation at the end of ten years, investigations should be

made every seven years, with corresponding distributions of surplus. This

accentuated the anomalous disabilities incurred by those who did not

insure at the proper time.

For example : a

person insuring on 1st January 1820 would have to wait until 1st January

1832 before he derived any of the special benefit attaching to membership

in a mutual society, notwithstanding that his contributions for five years

previous to 1825 had gone to swell the surplus at the second

investigation. And whereas the bonus was calculated, not in proportion to

the number of annual payments of premium, but solely in proportion to the

amount of benefit insured, he would derive no advantage in the

distribution at 1st January 1832 over a person insuring on 30th December

1826, although the policy was seven years older.

The Court of Directors fully recognised the inequity

involved: the difficulty was how to remedy it. On 7th February 1820 the

problem was remitted for solution to a committee consisting of Mr. John

Clerk, [1757-1832. Solicitor-General for Scotland in "All the Talents"

Administration, i8o6. Raised to the Scottish bench in 1823 as Lord Eldin.

His bodily infirmity interfered seriously with his reputation as a judge,

but he had a lively Wit. One day in the High Street he overheard one young

lady say to another "Yonder goes Johnnie Clerk, the lame lawyer." Clerk

turned and said: "No, madam; I may be a lame man, but I'm not a lame

lawyer."] Mr. James Moncrieff, [1776-1851. Succeeded as 9th Baronet in

1827; raised to the Bench as Lord Moncrieff in 1829.] Mr. Patrick

Cockburn, and Mr. David Wardlaw.

Before

following the deliberations of that committee to their important finding

and conclusion, the following notes may be found interesting as evidence

of the growing strength of the Society.

7th

May 1821.—The limit of risk on a single life was extended to L2000, except

in such cases wherein "on any ground any addition above the ordinary rate

of premium is exacted." This extension seems to have been anticipated by

the decision of the directors on i 5th April foregoing to accept a

proposal by Mr. Archibald Geddes, aged 28, for an endowment of £2000

payable at 50 years of age. There is no mention of reassurance, and the

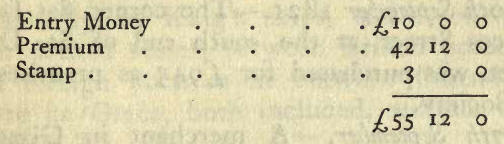

charges against the proposed were

18th rune 1821.—An Extraordinary Court took into

consideration the hearing of one of the Articles of Constitution which

provided that if any person whose life was assured by the Society should

die upon the high seas (persons passing in His Majesty's packets between

Great Britain and Ireland, or in the usual passage vessels sailing between

Leith and London, excepted) his policy should become void and the

liability of the Society should cease and determine. The exception to this

rule having been extended on 1st February 1819 to persons travelling "by

all the regular and established ferries in the United Kingdom," the

Extraordinary Court now considered "that passage by steam vessels has of

late years become frequent, and, so far as known to this Court, is at

least equally safe with conveyance by the vessels falling under the

foresaid description in the Articles of Constitution" (i.e. sailing

packets), resolved that the exception should be extended to insured

persons "passing along the routes described, and in all routes of a

similar description within the United Kingdom, in steam vessels or packets

as well as in the usual passage vessels sailing on such routes."

xotlz September 1821.—The corner flat facing Princes

Street, at the south end of St. David Street, was purchased for C945 as

premises for the Society.

17th September.

—A merchant in Glasgow, having an insurance for £2000 on the life of Lord

Fife,' offered to pay the additional premium due on account of his

lordship going to Paris " for a few weeks," and "for the risk attending

his return from that country to Britain," suggesting that there should be

no extra charge as the voyage "is little more than crossing from Leith to

Kinghorn." The directors granted the required license on payment of an

additional premium of 2s. 6d. per cent on the sum assured "for the sea

risk from Great Britain to France and back by way of Dover and Calais."

Thereupon Mr. Forlong's agents wrote to say that Lord Fife [James, 4th

Earl of Fife (1776-1857); joined the Spanish army as a volunteer in 1808,

and rose to the rank of major-general. Wounded at Talavera and Fort

Matagorda.] might not return by way of Dover and Calais, but from Dieppe

or some other port in the Channel, and asking for the license to be

extended accordingly; which was agreed to.

The rule affecting sea risks was altered by the Extraordinary Court of 5th

November 1821 so as to allow insured persons "to pass occasionally by sea

from one part of the United Kingdom to another, and also in time of peace

to pass occasionally, in King's ships, steam-vessels, or other decked

vessels between British ports and such foreign ports as lie between Ostend

and Havre de Grace, both included, without extra premium."

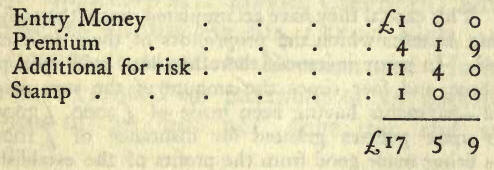

1st October 1821.—The proposal of Roger Aytoun,

W.S., for an assurance for C16o on the life of Lieut. D. M. Sanders, 49th

Regiment, to cover military risk in Europe, the Cape, and the East Indies,

and the voyages between these parts, was accepted with the addition of 7

per cent per annum on the sum assured, making a total payment of:

12th November. -At the eighth annual general

meeting, the President, Lord Rosebery, took the chair for the first time.

In the course of his address he said that "he felt a degree of national

pride in observing how much the existence of such institutions [as the

Scottish Widows' Fund] excites the astonishment of foreigners, to whom the

very name of Life Assurance seems yet to present an aspect of inscrutable

mystery, and to convey something like the ludicrous idea that there

positively exist establishments by means of which human life may be

actually secured against the numerous casualties to which it is exposed."

Mr. James Gibson of Ingleston, an extraordinary

director, in the course of some remarks congratulating members on the

state of the Society, which in the course of seven years' existence had

accumulated funds to the amount of £26,154, drew a comparison between its

growth and that of the Equitable.

"The

Equitable," he said, "has been established little more than fifty years,

and its prosperity has been unexampled. It now possesses a capital almost

beyond belief. Two years ago, when I was in London, I saw a state of their

funds, one article of which consisted of seven millions of three per cent

Government stock. This capital they have accumulated, notwithstanding the

immense benefits which the proprietors of their policies have received. In

many instances there has been paid upon policies two, three, and four

times the amount of the sum originally insured—payments having been made

of £2000, £3000, and £4000 upon policies granted for insurance of £1000,

the surplus being made good from the profits of the establishment. The

Scottish Society never can rival the Equitable Society in number of its

members or the amount of its capital, the field in this country being so

much more limited; but the prosperity of the Scottish establishment gives

undoubted assurance that the benefits to each individual member will be as

great." As a comment upon the words in

italics, but in no spirit of vainglory, it may be noted how far the

Scottish Society has outstripped its English ally. At 31St December 1909

the Equitable had sums assured by 6250 policies, amounting, with bonus, to

£8,400,000. At 31st December 1908 the corresponding liabilities of the

Scottish Widows' Fund were £39,000,000 assured by 58,712 policies.

7th 7anuary 1822.—A policy for £300 was granted on

the life of a military cadet aged 20, with 7 per cent per annum additional

on the sum assured, viz. 5 per cent for voyage to and residence in India,

and 2 per cent for military risk in India.

6th May.—The Manager recommended the expediency of reducing the rates of

present annuities, owing to the difficulty he experienced in finding

profitable investments for the purchase money, and also for the care taken

in selecting lives on which annuities were purchased.

19th August.—Mr. David Cleghorn, having two policies

on his life for £i000 each, asked for a license to travel to Dresden and

Holland, which was granted on payment of an additional premium of 2s. 6d.

per cent on the sums assured.

26th

August.-Sir Walter Scott having applied for an assurance on the life of

his brother, Thomas Scott, W.S., paymaster of the 70th Regiment, serving

in Canada, the proposal was accepted for £1000, with an additional payment

of 2 per cent on the sum assured for residence in Canada, conditionally

upon the receipt within six months of a medical certificate corroborating

Dr. Bryce's certificate of Mr. Scott's health, etc. The policy was

declared void, and the entry money and premium were returned to Sir Walter

[Sir Walter became an extraordinary director of the Edinburgh Life

Assurance, founded in 1823.] on 18th November, in consequence of the

failure of Thomas Scott to forward the stipulated certificate. In fact,

Thomas died before the end of the current year.

4th November 1822.—The directors, taking into

account the Society's accumulated funds £41,090 :11 : 5) and its annual

revenue (£10,635 : 13 : 6), and that various proposals for insurance had

been made for sums greater than the existing regulations authorised,

extended the maximum risk on single lives to

£3000.

A barrister going to practise in Bombay was admitted

a member on payment of 5 per cent additional on the sum assured for Indian

risk.

18th November.- The directors met for the

first time in the new office of the Society, 2 South St. David Street.

7th July 1823.—The earliest suggestion for establishing a new class of

assurances at reduced premiums, but with no claim to a share in surplus

profits, was referred to the Quarterly Court for consideration, but no

further action was taken at this time (see minute of 11th June 1832).

8th December 1823.-A license was granted to Sir Charles M. Lockhart of

Lee, whose life was insured for £2500, "to sail in his pleasure boat," on

payment of an additional premium of los. per cent on the sum assured.

2nd February 1824.—The directors having at previous meetings approved of a

loan of £1500 to Mrs. Halkett-Craigie at 7 per cent, and to Mr.

Whyte-Melville of Bennochy and Strathkinness of £10,000 at 7 per cent, the

Manager reported that, in order to make these loans, it might be

necessary, for the first lime, to overdraw the bank account. The

Extraordinary Court thereupon empowered the trustees to overdraw to the

necessary amount.

9th February. - An overdraft of £4000

on- the account at the Royal Bank was arranged at 4 per cent interest, the

same to be repaid by instalments from day to day.

26th

July.—The Manager reported that the aforesaid overdraft at the Royal Bank

had been repaid, and that there was now £4000 to the credit of Society at

the two banks.

The Committee appointed on 7th February

1820 to consider the question of the division of surplus funds, presented

a weighty report on 5th November 1821, recommending, inter alia, the

following changes in the system laid down in the Articles of Constitution

:- 1. That after the investigation as at 1st January

1825, investigations should be quinquennial instead of, as originally

decreed, septennial.

2. That at every investigation

subsequent to 1st January 1825 every member of the Society should share in

the distribution of surplus funds, irrespective of the date at which he

joined, but calculated in proportion not only to the amount of the benefit

assured, but also in proportion to the number of annual contributions paid

by such member since the previous investigation.

3. That

annuities should share in the profits.

4. That bonuses

should be compound: that is, proportioned to the benefit assured to any

member, plus such bonus or bonuses with which it may have been credited

previously.

5. That single premium payments, or any

other mode of contribution different from annual payments, should carry

the right to bonus additions to benefits.

6. That

contingent prospective bonuses be paid.

The report was

taken into consideration by an Extraordinary Court on 14th January 1822,

but the case proving too complex to enable it to be grasped at once in all

its bearings, decision was postponed till the next quarterly meeting, Mr.

Cockburn being requested to prepare and circulate "such further

observations explanatory of the report as might tend to elucidate the

principles therein contained." This he did most thoroughly, dealing also

with a fresh difficulty which arose through the old members (that is,

those who had joined the Society previous to 1st January 1820) demurring

to having their prior rights infringed by the proposed new principle of

distribution, which, they pointed out, was a departure from the practice

of the Equitable Society, whereon the Scottish Widows' Fund was

professedly modelled. The exemption of new members from the five years'

qualification for sharing in the distribution of surplus at future

investigations would diminish, they pointed out, the source whence old

members were entitled to look for their bonuses, thus involving a breach

of the conditions which they had accepted in joining the Society. This

difficulty was overcome by the adoption of a rule under which a portion of

the additions to which the old members would be entitled at the

investigation of ist January 1825 should be held in suspense until the

second investigation in 1832, when that portion of the additions should

become a vested interest in the survivors, and a preferable charge upon

the surplus then to be declared.

"In this way," said Mr.

Cockburn, the interest of the old members is ultimately provided for

without violating any of the fundamental articles of the Constitution ;

and they, in common with the new members, who may die during the interval

between the first and second periods of investigation, will secure to

their families additions corresponding to the time of their survivance,

which was one of the great ends proposed to be attained in altering the

original rule of distribution. The only difference to the old members is

that a portion of the addition to which they would have been entitled at

the first period of investigation is held in suspense until the second

period of investigation (except in regard to those who die in the

interval, who will receive the full amount), and that their becoming

entitled to that portion is dependent upon there being a surplus at the

second period. When, however, the old members reflect that in lieu of that

risk (which in the present flourishing state of the Society can be

accounted as nothing) they will secure to the families of those who die

before the second period of investigation prospective additions

corresponding to the time of their survivance, and that they achieve a

very important improvement in the mode of distribution of the surplus

funds, I cannot anticipate any objection on the part of that class of

members."

The recommendations of the Committee, having

been repeatedly and anxiously discussed by the directors, were at last

laid before the eleventh annual General Court of the Society, held in

Oman's Waterloo Tavern on 8th November 1824, immediately before the first

investigation and distribution of surplus. The recommendations aforesaid

had undergone several important modifications in the three years during

which they had been under consideration. The proposal to shorten the

investigation period from seven to five years had been abandoned; nor was

any change made in this respect until the obligation to hold quinquennial

investigations was imposed upon the Scottish Widows', in common with all

other Assurance Societies, by the Assurance Companies Act of 1909; the

proposal to extend the bonus system to annuities and short term policies

had been withdrawn, the benefit of participation being restricted to the

holders of policies for the whole term of life.

The

General Court was numerously attended, under the presidency of Lord

Rosebery; the recommendations of the Committee were cordially approved,

and were referred for further consideration by a General Court to be held

on i6th May 1825. The General Court was so held, but it is curious that

there is no reference in the minutes to the matter which had been

specially remitted to it. The only business recorded as having been

transacted was the granting of authority to the directors to apply for a

royal charter of incorporation and the appointment of Mr. Wotherspoon, son

of the deceased Manager, as Assistant Manager to Mr. M'Kean.

It was natural that the result of the first investigation should be

awaited with intense interest by the members of the Society, especially by

the old members who alone were entitled to participate in the distribution

of surplus. The result, as announced to an Extraordinary Court on 7th

February 1825, exceeded the most sanguine expectation. The gross funds had

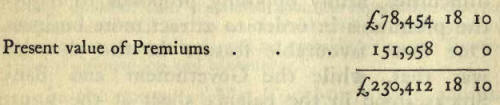

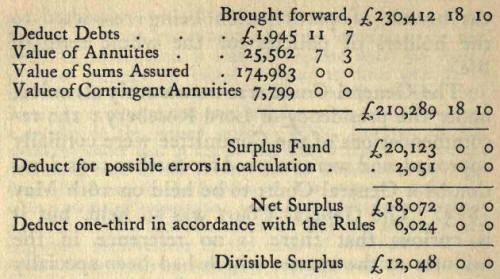

rolled up to the respectable figure of

The first bonus was declared by an adjourned Extraordinary Court on iith

April 1825 as follows

A vested bonus of 12 per cent on

all policies existing at 1st January 1825, with a further bonus of 14 per

cent to be paid on all claims emerging before 1st January 1832, making 26

per cent in all. There was a pardonable note of exultation in Mr.

Cockburn's address to the general meeting. He had been all along the

resolute guardian of the young Society's stability, resisting consistently

every attempt to meet current expenses out of capital, and, after the

Society had extricated itself from its initial difficulties, firmly

opposing proposals to reduce the premiums in order to attract more

business. One most favourable feature in the situation was that, while the

Government and Bank Stocks stood in the balance sheet at the figure

(£36,287 :16 : 9) at which they had been bought, they had all risen in

value since ; a state of matters which may he wistfully regarded by

directors of joint-stock concerns at the present day, who have become

painfully inured to the depressing duty of writing down the value of their

securities.

At the same time Mr. Cockburn warned the

meeting against assuming that the existing buoyancy of their resources was

sure to continue. Their experience so far showed a rate of mortality among

the members considerably lower than that presented in the Northampton

tables whereon their rates were founded, owing in an important degree to

the fact that the deaths in the early stages of a Society are much less

frequent than they become in its later stages as the average age of the

insured increases. Mr. Cockburn supported the conclusion at which he had

arrived by pointing out that the deaths of members during the first ten

years of the Scottish Widows' Fund had been one-sixth less than those in

the older Equitable Society during a corresponding period.

"We ought not, therefore," he continued, "to calculate too highly upon the

magnitude of the surplus funds arising during the early stages of an

assurance society. Those institutions which diminish their premiums upon

the expectation that the surplus funds will be the standard of their

progress proceed upon a very insecure basis, and are probably laying the

foundation of ultimate loss and bankruptcy."

In the

course of Mr. Cockburn's long address there occurs one passage which,

spoken by this confident, yet cautious, pioneer in Scottish life

assurance, merits attention from members of a Society occupying the

position in public esteem now held by the Scottish Widows' Fund.

"When I recollect the origin of our Society, consisting of some half dozen

members with a fund of £500 or £600— when I consider the pains and trouble

with which our present fund of £75,000 has, during a period of ten long

years, been scraped together, and contrast that amount with the millions

of capital which, in an instant, are everywhere springing up around us, I

cannot help shrinking under the idea of the insignificance of our

establishment, and am lost in wonder and admiration at the riches which,

after years of deep complaint from all the various classes of the

community one after another, have now poured in upon our heretofore sore

oppressed, and now happy, land. While I am absorbed in these reflections,

however, there is one ray of comfort comes across my mind, from which I

have no doubt you will derive equal consolation—that if the sums which we

assured for the benefit of our families are not guaranteed by millions, we

have not to pay for that guarantee. . . . Under the protecting care of a

Divine Providence, who has promised to be a husband to the widow and a

father to the fatherless, we have every reason to hope that our

institution, which has now got over the risks and perils of the infant

state, will not only be the means of communicating comfort and happiness

to the friends and relatives of the present members, but that it will shed

its benign influence over generations yet unborn."

The

directors were not unmindful of the help and guidance they had received

from disinterested friends; wherefore on 24th March following the first

investigation the Court allotted a sum of 120 guineas "for purchasing

snuff-boxes or pieces of plate to be presented by the Society to Mr.

Morgan, Lord Eldin, and Mr. Moncrieff as a grateful remembrance of their

services in revising the Articles of Constitution and of the benefits

derived from their occasional advice during the progress of the Society,

and to Mr. Beveridge for his valuable assistance in framing and adjusting

the clause of distribution." |