One of the most continuous and remarkable features of

Scottish banking over the years has been the issue of bank notes by

almost all banking institutions. There are now just three note issuers.

The issue of notes has also been one of the most successful aspects of

the system. Yet the experience of most other countries has been neither

so successful nor so continuous. Most countries today have notes issued

only by a central bank, but Scotland remains one of the few countries

where each bank has its own note issue. This poses the questions as to

why the Scots have been permitted to continue.

The first notes were issued by the Bank of Scotland

when it commenced business in 1695. These were £5 notes but £1 notes

followed in 1704, and as the system developed through the period of the

Industrial Revolution, banks issued notes of these and other

denominations, although £5 and £1 notes, particularly the latter,

remained the most popular. The successful issue of notes was absolutely

vital to the success of banks, for profitability depended almost

entirely on the ability of banks to put their notes into circulation and

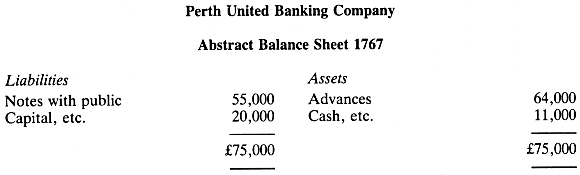

keep them there. The truth of this can be illustrated from an abstract

of the first balance sheet of the Perth United Banking Company.

In the age before deposit banking was common, banks

advanced money to customers by issuing notes to them. The customer then

used the notes to finance his business and eventually the notes would

find their way back to the banker who issued them. The banker could then

either retire each note by paying cash (coin) for it or he could reissue

it by making a further advance to a customer. Naturally he preferred the

latter course of action, for advances earned the banker the interest on

which his profitability depended. If on the other hand he retired the

note this would have the effect of reducing his reserve assets and, if

the banker was trying to maintain a fixed ratio between reserve assets

and liabilities, he would then have to take steps to reduce advances

(earning assets) and increase cash (non-earning assets). This would have

adverse consequences on profits.

Bankers then sought to make their business profits by

advancing money to customers by means of their note issue. The note

issue was then kept at a high level by increasing advances when notes

were returned for payment or when old advances were paid off. If the

bankers had not had the ability to issue notes then the economy would

have been denied much of the credit which helped to finance the

Industrial Revolution and the bankers would have been denied much of

their profit. Until the 1830s when the Usury Laws were modified before

being finally abolished, the maximum rate of interest which could be

charged on an advance was 5 per cent per annum. The cost of printing and

issuing notes at that time was minimal so that the profit margin on the

note issue was in the order of 4½ per cent.

The more notes a bank could issue, then, all other things being equal,

the greater the profits would be.

Not unnaturally this facility led to some abuse in

the earlier years. The first abuse was that some banks, mostly the

smaller ones, tried to force more notes into circulation than the public

really wanted to hold. They did this by paying a commission to "note

pushers" who went round shopkeepers and merchants offering to exchange

any bank notes in their possession for those of their employers. The

expense and folly involved in this, however, ensured that the practice

did not continue for long. More serious was the problem of small

denomination notes. There was no legal restriction on the issue of notes

in Scotland, and notes could be issued by anyone and in any

denomination. This resulted in the proliferation of small note-issues

throughout the country and which culminated in a major abuse; the "small

notes mania".

Britain entered the Seven Years' War with France in

1756 and partly as a consequence of wartime finance and troop movements,

Scotland's balance of payments with Europe and London became adverse

causing a drain on coin of all descriptions. The coinage was already

inadequate due to the deficiencies of the Royal Mint and this drain had

the effect of exacerbating the problem. Many trades faced with the

difficulty of finding coins to use in business, resorted to producing

their own. These were known as trade tokens but other traders found that

it was even cheaper to produce and issue notes. The result was a rash of

note issues up and down the country in denominations often as small as

one shilling (5p). The people issuing these notes sometimes described

themselves as bankers but more often they were simply shopkeepers. Part

of the result of this increase in the circulating medium was inflation

as the supply of money increased without any commensurate increase in

the supply of goods.

The problem, however, was compounded by what was

known as the option clause. Several banks having experienced difficulty

in obtaining supplies of coin, had included in their notes, a clause

which gave them the option of paying coin for their notes to anyone who

wanted it either on demand or, at the option of the bank, at the end of

six months from the date when payment was demanded. (See below for

illustration.)

Dundee 8th Aug. 1763 £1

1 Robert Jobson, Cashier to George Dempster and

Co., Bankers in Dundee, in virtue of powers from them promise to pay

to---------------- or the Bearer on demand at the Companys Office

here One Pound Sterling, or, in the option of the Directors, One

Pound and Sixpence Sterling at the end of six months either in Cash

or in Notes of the Royal Bank or Bank of Scotland, and for

ascertaining the Demand and Option of the Directors the Accomptant

is hereby ordered to mark and thus note on the back hereof.

The situation which had evolved by the early 1760s,

just as Scotland's economic development was beginning to gather pace,

was potentially very damaging. Not only was the issue of notes

completely uncontrolled, but it was pursued in a way which could inflict

great damage on the economy. Clearly some control was required.

Political pressure for the imposition of some

regulation came from the bankers themselves and they were successful in

pushing through legislation in 1765. The Act prohibited the use of the

option clause, made £1 notes the smallest which could be issued and

allowed summary diligence (a simple legal procedure) on bank notes, so

that if any bank refused to pay coin for its own notes when asked, it

was then a simple matter for the holder of the notes to proceed at law

to try to enforce payment.

The Act was a milestone in the history of Scottish

banking. Certainly it permitted freedom of issue so that anyone could

set up as a banker and issue notes and this had a potentially

destabilising effect on the economy but, most importantly, it ensured

that notes were payable in coin on demand, i.e., that they became

legally convertible into legal tender. It was the absence of

convertibility in many other countries which resulted in the failure of

note issues and banks. The existence of convertibility in Scotland

ensured the increasing popularity of bank notes and the certainty that

people could obtain coin on demand in exchange for their notes, meant

that few asked for it. This enabled the banks to keep smaller reserves

of gold and silver coin and to expand their businesses accordingly.

Although the initial problems associated with note

issues were overcome by the Act of 1765 the banks had still not learned

to live in peaceful co-existence with one another and instead often

treated their competitors with great suspicion and hostility. It did not

take long, however, before part of this problem was resolved.

In 1771 the Bank of Scotland and Royal Bank of

Scotland decided to set up a note exchange and persuaded other issuing

banks to join it. (They had operated their own exchange from 1751.) The

existence of the exchange facility encouraged banks to take the notes of

other banks in payments over the counter, and so added greatly to the

smoothness of the payments mechanism in Scotland. The fact that banks

would take the notes of other banks in payment encouraged traders to do

likewise. The result was a general expansion of note issues and a

consequent growth of the banking system.

Just as important as the growth which developed from

the note exchange, was the increased stability which the exchange gave

to the system. Banks could no longer force their note issues and create

an unrealistic circulation for themselves. Notes which found their way

into the hands of other banks—and there was an increasing tendency for

this to happen—soon found their way to the exchange and from thence back

to the issuing bank. The note exchange therefore was an important check

to the over-issue of notes. It was the first of its kind in the world.

Having overcome the difficulties at an early stage

the system was then free to grow unhindered. The Scots had been

fortunate in 1765, that the Act of that year had allowed them to issue

notes from £1 upwards. The English were not so fortunate. When

legislation was passed in 1775 and 1777 it was enacted that the £5 note

should be the smallest denomination. This had serious consequences for

the development of banking in the two countries. The existence of the £1

note in Scotland had meant that the banking habit percolated down to

most levels in society and gained the support of the mass of the people

for the banks and the banking system. This never really happened in

England where, for many years, the £5 note was the smallest

denomination, and £5 was a substantial sum of money in the age of the

Industrial Revolution. The banking habit was, therefore, less popular in

England than in Scotland at this time, with the result that the banks

were less well supported in times of commercial distress.

During the Napoleonic Wars because of the general

shortage of coin, English banks were allowed to issue notes of smaller

denomination and many did so, but when the war ended plans were made to

terminate the issues of these £1 notes which were blamed, by some, for

the inflation which had taken place. It soon became known that the

Government planned to put an end to small denomination notes not only in

England but in Scotland and Ireland. The result was a deluge of

petitions from all over Scotland from bankers, industrialists, merchants

and town councils in support of the status quo. Perhaps the most

dramatic impact on the debate which followed was made by Sir Walter

Scott in a series of letters to the Edinburgh Weekly Journal

under the ill-disguised pen name of Malachi Malagrowther. As a result of

this pressure the Government set up committees of the Lords and Commons

which took evidence between March and May 1826. Bankers who gave

evidence to the committees claimed that if small notes were abolished,

then they would no longer be able to operate the cash credit system nor

to pay interest on deposits, with the result that the benefits of these

services would be lost to the economy. The overwhelming weight of

evidence in favour of the Scottish banking system resulted in the Scots

being allowed to keep their small notes, and the only change that was

made was that they were banned from circulating their notes in the north

of England which had been their practice for many years.

The right to issue small notes had been defended with

great energy and justification for, as the Lords Commissioners concluded

in their report the Scottish banking system was—

"found compatible with the highest degree of

solidity and had the best effects upon the people of Scotland, and

particularly upon the middling and poorer classes of society, in

producing and encouraging habits of frugality and industry."

The enquiry of 1826 marks the high point of the

Scottish note issue, for thereafter it began to decline in importance as

a source of profit to the banks although, of course, its popularity did

not decline.

In the 1830s and 1840s great strides were made in the

development of the Scottish economy. This was the age when a success was

made of the iron industry for the first time, when railways were built

and when there was substantial urban growth. In short, it was a period

of rapid technological and social change. But just as the economy was

changing so the banking system transformed itself to meet the challenge

of the new scale of industry. The joint-stock banks which developed in

this period placed much more stress on deposit banking than on note

issuing. Transferring money from bank account to bank account by cheque

began to develop and was soon commonplace, particularly in the cities.

The result of this was that when the system was again

threatened with legislation in the early 1840s it was defended with much

less energy than it had been in 1826, yet the pressure which the

Scottish banks did exert, ensured once again that they would be treated

differently from their English neighbours. In England legislation passed

in 1844 ensured that no new bank of issue could be formed. Even the Bank

of England did not escape from the restrictions. Its issues were

confined to a fiduciary issue of £14m plus an amount equivalent to its

reserves of gold and silver. The long-term effect of this—largely as a

result of the merger movement in English banking—was to confine the

right of issue entirely within the hands of the Bank of England.

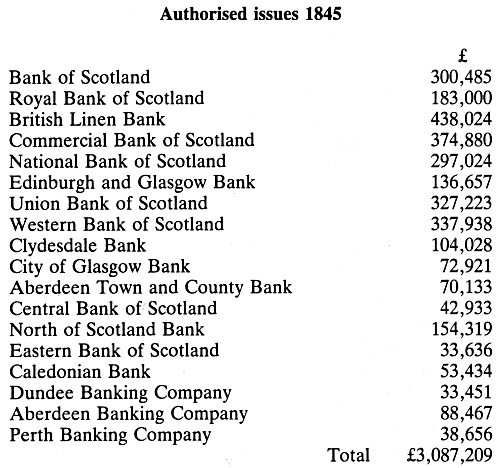

In Scotland, however, an Act of 1845 prohibited the

formation of any new banks of issue. Banks already in existence were

given an "authorised issue" equivalent to the average of their issues in

the year preceding 1st May 1845. The banks were given permission to

exceed this limit provided that the excess was covered by reserves of

gold and silver (three-quarters gold) held in the banks' own vaults. The

amounts authorised were as follows:

If the Scots had not been treated differently from

the English by being allowed to keep their note issues when they merged

with another bank there would now be no Scottish bank notes.

The success of the Scottish note issue until this

time has been achieved without notes having become legal tender except

in war-time. That they were not legal tender had been established in a

court case in 1756. Nevertheless the public had displayed an increasing

preparedness over the years to accept bank notes in payments and to use

them in their businesses and in their private lives as a medium of

exchange. Their willingness to do so was in large measure attributable

to the convertibility guaranteed by the Act of 1765, and also to the

great faith which they placed in their bankers, a faith which was

justified by experience.

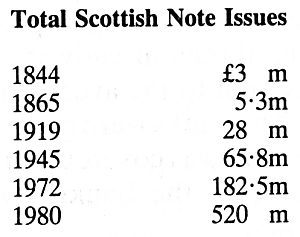

After 1845 the Scottish note issue grew in volume but

declined in importance. The figures below indicate the trend.

Notwithstanding this substantial increase in volume,

however, the note issue declined in importance as an earning asset after

1845, as all notes issued in excess of the authorised issue had to be

covered in the banks' vaults by non-earning assets i.e., cash or

bullion although nowadays the banks keep these reserves in the form of

Bank of England notes and coin held at two approved offices in Scotland,

or certificates in respect of notes deposited at the Bank of England.

These are non-earning assets. The effect of this is that the note issue

is not so important for the profitability of the banks as it once was.

Nevertheless the banks contend that their issues are still profitable

and worth maintaining, and the right to issue notes is zealously

guarded. This is also a highly useful advertising medium because they

present the banks' names to the public every time they make a

transaction. The advantage of having their own notes as till money also

enables the banks to keep open some rural branches which might otherwise

have to be closed.

The Scottish note issue, like that of Ulster, is very

much a domestic issue being confined to the country of issue. It remains

illegal for banks to issue Scottish notes in England. These note issues

are not legal tender even in Scotland although, of course, they are

accepted without question for payments for all kinds of transactions.

Nevertheless many tourists who go abroad on holiday and take Scottish

bank notes may find to their embarrassment that these notes are not

readily acceptable or, as once happened, find to their delight that they

can get a better rate of exchange than for Bank of England notes. It

used to be the practice of English banks to charge their customers six

old pence (2½p) for accepting Scottish notes

and this led to English shopkeepers either refusing to accept Scottish

notes or giving only 19/6d (97½p) for them. This practice has now ceased

although many English shopkeepers are still rather suspicious of

Scottish bank notes.