The bank balance sheet of today is a very sizeable

and comprehensive document and few people would argue that they should

be made to reveal more information than they, at present, contain. Yet

this has not always been the case. In fact the publication of balance

sheets with related accounts is a late 19th century development. Before

then no banks published their balance sheets although of course all

banks compiled them.

In the very early days of banking the Bank of

Scotland drew up a balance sheet only every three years. It is

impossible to be certain about the Royal Bank for its archives have not

survived for the early years. Yet by the mid-18th century when some of

the early provincial banks were set up it does seem that the standard

practice was to draw up balance sheets at least yearly. Some elements of

these balances—particularly profit figures were read to shareholders at

annual business meetings although they were not published. In this

regard the Scottish banks were ahead of most other forms of business

organisations at the time. One historian speaking of businesses

generally down to 1830 wrote that—

"Balances are struck, not at regular intervals,

as checks and controls, but at the end of books, to save transfers

to new folios." (S. Pollard)

Given that most businesses at the time were simple

partnerships with only a few partners most, if not all of whom, were

involved in management this is not surprising, but many of the banks

numbered their shareholders in scores and management was in the hands of

elected boards of directors. So it was this early joint-stock form of

organisation which made regular reporting necessary; for shareholders

with unlimited liability could not be expected to commit their funds and

bear the risks without receiving some information about the state of

health of their business. There were frequent rows about the amount of

information which should be given to shareholders with directors usually

arguing that it was necessary to be secretive so that information which

they regarded as sensitive did not fall into the hands of business

rivals.

So the early accounts of Scottish banks were shrouded

in secrecy but this reticence on the part of bankers to publish

information has also obscured the very real contribution made by banks

to the development of accounting practice and indeed to the accountancy

profession.

The early development of banking in Scotland

necessitated that elaborate book-keeping systems should be developed and

that books should be balanced at regular intervals. This in fact

happened in banking before it developed in other industries and banks

therefore gave to their clerks a training which was to command high

salaries elsewhere. Many who described themselves as accountants in the

early 19th century had received at least part of their training in a

Scottish bank.

An examination of the archives of 18th century

banking, however, reveals that their were no uniform practices between

banks. Most of the early balance sheets show no attempt to rank assets

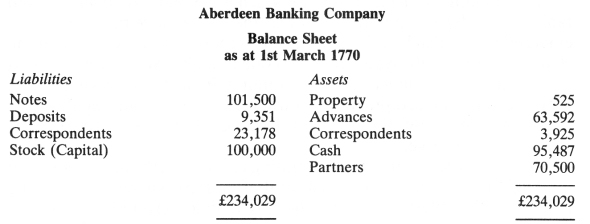

and liabilities in any particular order. For example, the balance sheets

of the Perth United Banking Co. from 1767 list balances simply in the

order in which they occur in the ledger but the ledger of the Aberdeen

Banking Company from 1767 shows some attempt to rank balances in order

of liquidity. For example an abridged version of the 1770 balance sheet

reads:—

This balance sheet bears a striking resemblance to

its modern day counterpart although a 20th century bank might be

inclined to list the assets in reverse order with the most liquid at the

top. Nevertheless, despite the similarities and despite the great

advance in accountancy which this balance sheet represents it would not

pass the scrutiny of a modern auditor. For example, the Stock (Capital)

balance is the nominal capital and not the paid up figure. To get the

correct figure the reader must subtract the Partners' balance of £70,500

on the assets side which represents uncalled capital. The real figure

for paid up capital is therefore £29,500. The idea of treating uncalled

capital as an asset is one which took a long time to die in the

accountants' world. Similarly the figure for notes is in fact notes

issued to the cashier and not notes in the hands of the public as it

would be in a modern balance sheet. This means that the cash figure on

the assets side is also wrong for it must contain a sum for the bank's

own notes in the hands of the cashier not yet issued to the public.

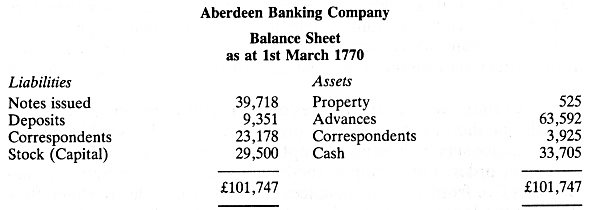

Fortunately the Aberdeen Banking Co. is one of the few banks for which

it is possible to break down the cash figure into its component parts

and this reveals that the notes and cash figures must be reduced by

£61,782 to get a true picture of the bank's affairs. The balance sheet

can now be redrawn.

The idea that a bank's own unissued notes could be

part of its cash reserves was one which persisted well into the 19th

century.

The keeping of proper accounts which were regularly

balanced and ranked in order of liquidity was only one of the

developments which emerged in Scottish banking. (It must be recognised,

however, that the claim to be first is always a dangerous one to make.

What is clear is that these accounting practices became common in

Scottish banking before they became standard practice elsewhere.) Other

accounting developments included provisions for bad debts, depreciation

of fixed assets and revenue reserves.

Whatever the advances in accounting techniques the

achievement of the bankers remained concealed until after 1857 when,

following the failure of the Western Bank, the Clydesdale responded to

public comment and began to publish an annual balance sheet. The other

banks followed suit in 1865 but the information given was in a very

truncated form.

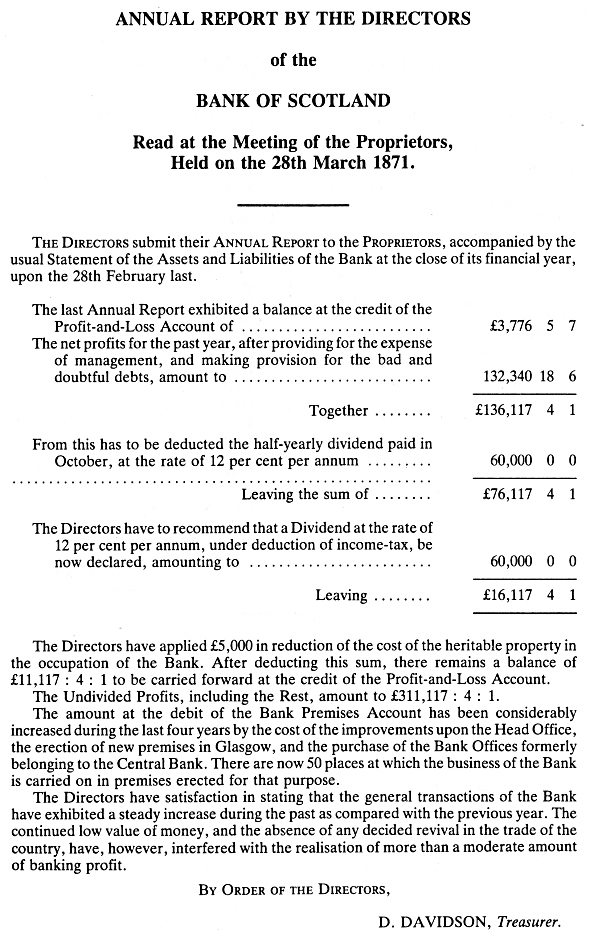

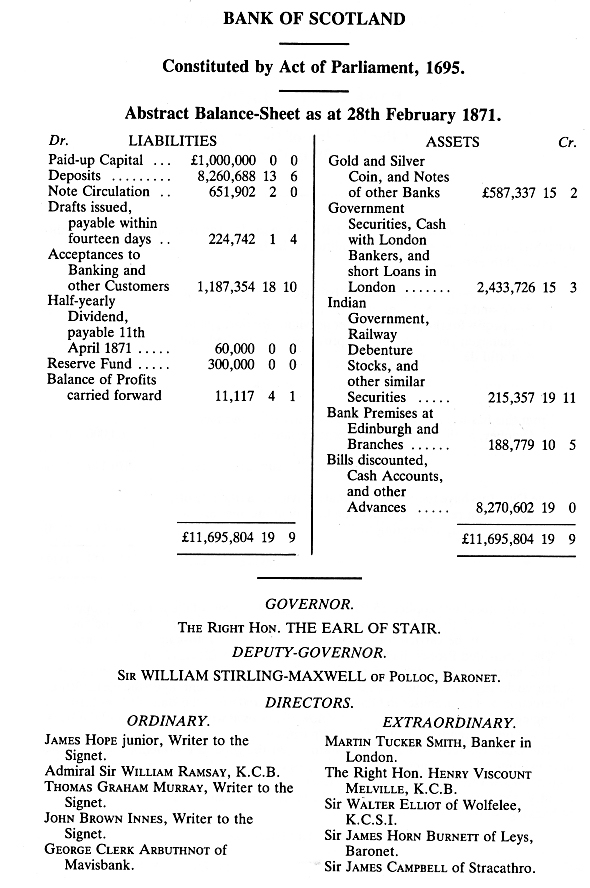

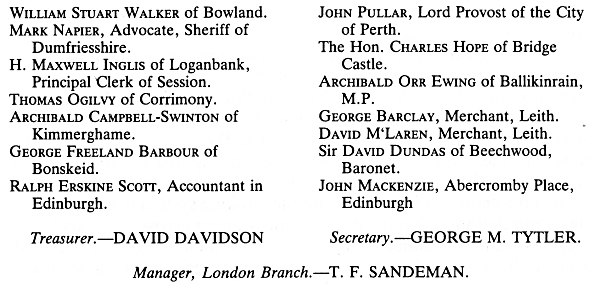

Many of the problems which we have mentioned were

overcome by the 1860s when the banks began to publish their balance

sheets. An early report of the Bank of Scotland is reproduced here as an

example of the amount of information which was published. An examination

of this reveals that the problems of unissued notes and uncalled capital

had been overcome but the reader of this balance sheet and the very

brief report on profits and market conditions must have been left with

some unanswered questions in mind. What was the basis of valuation of

the property? Some items in the report suggests that it was not based on

historic cost. If not then what was the historic cost, the amount of

depreciation to date and the present market value? What implications

does this have for the liabilities, especially the reserves? What are

the maturities of the investments in Government securities and

debentures? Without this information the liquid reserve ratio cannot be

calculated. Is the reserve a capital reserve or a revenue reserve?

These are only some of the questions which a modern

commentator would ask of the balance sheet. As to the report, even more

questions could be asked of it. What are the elements of income? How

many employees are there? Does the bank plan expansion? Are there to be

changes in the Directorate? What are the principal activities of the

bank? What is the provision for bad debts?

There was always a suspicion that banks did not

declare their true profits each year and that in good years transfers

were made to hidden reserves whilst in bad years these funds were

transferred back to the main profit and loss account so that good

profits could be declared and a regular dividend paid. Indeed this

practice was, to some extent, legally condoned and it was not until 1969

that the practice was ended and banks were forced to disclose their true

profits.

There was no requirement that accounts be audited but

this was introduced voluntarily by all of the banks shortly after the

failure of the City of Glasgow Bank in 1878. From then onwards the

amount of information disclosed in annual reports was gradually

increased either voluntarily or as a result of Companies Acts so that

today the range of information disclosed is very extensive indeed. Most

reports and accounts of Scottish banks now occupy a document of some

forty pages although some of the content is of an advertising nature.

Nevertheless this is a far cry from the two-page document of a century

ago.

Today's reports contain, inter alia, the names

of the directors, head office officials and senior managers. The report

of the directors contains matter which is required to be disclosed by

statute, profit and loss accounts and balance sheets both for the bank

and for the bank plus subsidiary companies, notes of explanation and

elucidation on the accounts, current cost accounts, auditors report and

lists of branches. There may also be a chairman's report and some

descriptive material on the activities of the bank. In short, the modern

report is a weighty and important document which reveals much of the

affairs of the bank. The age of secrecy has receded.

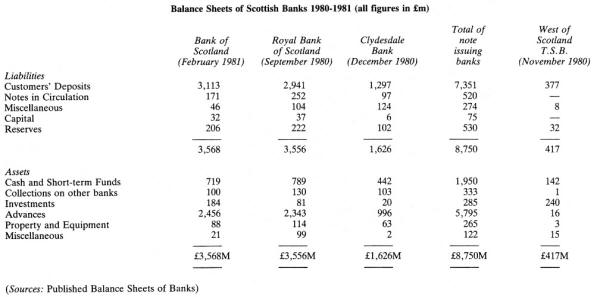

It is not possible to reproduce a copy of a report

here but the table below gives the balance sheets of the three clearing

banks which are then subtotalled. The West of Scotland Trustee Savings

Bank is then included as an example, although it must be borne in mind

that there are three other T.S.Bs at work in Scotland. The West of

Scotland T.S.B. is, however, the largest. A comparison of the figures

for the Bank of Scotland in 1871 and 1981 will reveal just how dramatic

the growth has been in the economy in general and the banking system in

particular. It may seem that there has been little improvement across

the years in the range of figures produced but it must be remembered

that the 1981 balance sheet is supplemented with several pages of

explanatory notes whilst there was nothing to explain the 1871 figures.