|

AMONG the manifold sources of disaster and sorrow

befalling civilised humanity, none has been, and none remains, more

prolific than Chance and Death - Chance, that elusive, incorporeal agency

which has lured gamblers by the thousand to moral and material wreck—

Death, which tears loving hearts asunder and brings to nought the wisest

schemes. Nevertheless, just as the most deadly drugs, prepared by

scientific pharmacists, may be applied successfully by physicians to

mitigate pain or expel disease, so men have learnt by slow experience to

turn to beneficent account the relation which these two intangible forces

bear to one another, and to harness them for the service of mankind. For,

as Euripides observed 2350 years ago:-

The experience needful to enable men to compel

Chance and Death to their advantage was gathered very slowly, as any one

may realise by glancing over the history of life assurance. [Babbage

attempted a formula distinguishing between the terms "assurance" and

"insurance." He defined assurance as a contract dependent on the duration

of life, which must either happen or fail ; and insurance as relating to

events that may partly happen or partly fail, such as injury to person or

property by fire, storm, or other accident. Walford (Insurance

Enyclopaedia) held that assurance represented the principle, insurance the

practice. Probably the true definition would be that a person insures with

an office and the office assures him against certain contingencies ; but

in practice the terms have become synonymous and interchangeable.]

As to death, indeed, all men had inherited the

experience that it was inevitable, and King David—or that anonymous

syndicate which the higher critics would have us regard as responsible for

the psalms attributed to King David— estimated the normal duration of life

at a figure which subsequent experience has done little to modify; but no

organised provision against death was feasible until the conditions of

government and society became such as to provide reasonable security

against the arbitrary interruption of human life.

So long as the scaffold and the gallows continued to

be recognised as the natural and readiest means of suppressing political

controversy so long as family and tribal feuds continued to be conducted

by private conflict and assassination—so long as nations could be plunged

into war at the bidding of autocrats—so long did the chances of life

remain incalculable.

Consider the social and political conditions which

prevailed in England and Scotland during the fifteenth and sixteenth

centuries, when these two countries waged almost incessant war with each

other. Every baron was liable to be summoned to a campaign at any moment,

and all his tenants were bound to follow their feudal master to the seat

of war. A common uncertainty thus affected the expectation of life in all

classes and in all parts of the two countries. Nor was that all. Life was

far more precarious in some districts than it was in others. Had there

existed in those days an Assurance Society, it would have baffled the

acumen of the most skilful actuary to draw up a table of mortality adapted

alike for the circumstances of a yeoman in the Cumberland fells or a laird

in Teviotdale, both being dwellers in the very cockpit of Border war, and

for those of a Cornish tin-miner or a parish priest in Warwickshire,

living remote from the seat of chronic war.

So much for the rural community. In towns the

probability of life was even less calculable. The universal neglect of

hygiene and sanitary provision—the indescribable filth of both streets and

dwelling-houses—afforded a fertile breeding-ground for virulent fevers,

which, always smouldering in the tainted alleys, swarmed forth at

uncertain but frequent intervals, in the form of the Black Death, to sweep

away its victims by the hundred thousand. In the outbreak of 1348-9 there

is reason to believe that one-third of the entire population of England

perished; the mortality in London alone has been reckoned at 100,000,

whereof 50,000 were buried in what is now Smithfield Market. The last

great visitation in 1665 carried off 97,306 inhabitants of London, or

nearly one in every five of a population of 500,000.

The first person to connect cause and effect in

regard to the plague, and to reflect upon the possibility of averting this

terrible scourge by removing the festering sources whence it sprang, seems

to have been Desiderius Erasmus (1467-1534). His intellect and disposition

were as far in advance of his contemporaries in this matter as they were

in the spirit of religious tolerance. Moreover, the misery attendant upon

a visitation of the plague was borne in upon him in youth by the death of

his mother, the break-up of his home, and the consequent compulsion

exerted by his guardians to force him into monkhood, a vocation most

hateful to him.

In later life he became powerfully impressed by the

dirt of English dwellings—those of the wealthy as well as those of the

poor. He discerned that which is now universally accepted as a cardinal

truth, namely, that epidemics are not to be accepted as acts of arbitrary

vengeance on the part of an angry God, but as the natural crop springing

from accumulated filth. Howbeit, Erasmus was not going to proclaim this

discovery. Not he! he has told us naïvely and frankly that he was not of

the stuff whereof martyrs were made. He had suffered enough already from

the enmity of the Sorbonne to make him wary of casting more pearls of

intelligence before the rulers of that citadel of obscurantism. In private

correspondence, however, he allowed himself to express the common sense

wherewith he was so superlatively endowed. Writing to his friend Francis

he describes a condition of things quite disgusting enough to account for

the frequency of epidemics.

I often wonder, and not without anxiety, why it is

that England hath been afflicted with pestilence so continually during

many years; above all with the sweating sickness, which seemeth almost

peculiar to that country.

The floors are usually made of clay, covered with

rushes that grow in the marshes; and these are moved so slightly from time

to time that the lower part sometimes lieth for twenty years on end, and

therein is an accumulation of spittle, vomit, urine of dogs and men,

fragments of fish, and filth of other kinds not to be described. Out of

this, when the weather changeth, arise vapours very pernicious, as I

think, to the human body.

It is, indeed, wonderful how any human constitution

could withstand the baneful conditions of mediaeval homes ; nor is the

wonder lessened by contemplating the grotesque phases of empiricism

through which the science of medicine had to struggle into existence.

Utter indifference to domestic cleanliness long survived Erasmus's

protest. At the present day there is not a city in Europe where sanitation

is more thoroughly understood or more rigidly enforced than it is in

Edinburgh; but hear how an English barrister, Joseph Taylor, described the

Maiden City when he visited it in 1705. It is necessary to leave out some

of the darker passages in his experience.

Every Street shows the nastiness of the Inhabitants:

the excrements lye in heaps. . . . In a Morning the Scent wai so offensive

that we were forc't to hold our Noses as we past the streets, & take care

where we trod for fear of disobliging our shoes, & to walk in the middle

at night for fear of an accident on our heads. The Lodgings are as nasty

as the streets, and wash't so seldom that the dirt is thick eno' to be

par'd off with a Shovel. [Journey to Edenborough, by Joseph Taylor, 1702.]

Conditions do not seem to have been any better at

Moffat, which was already a health resort, described by Taylor as "famous

for its Spaw." Here the travellers lodged with the Provost.

We met here with good wine, and some mutton pretty

well drest; but looking into our beds, found there was no lying in them,

so we kept on our cloaths all night, and enjoy'd ourselves by a good fire,

making often protestations never to come into this Country again.

This being the environment wherein town- dwellers

passed their lives at the beginning of the eighteenth century, it is not

surprising that it never occurred to business men that such lives were

insurable. Going back to still more primitive times, we do not find that

death was included among the casualties against which the Anglo-Saxon

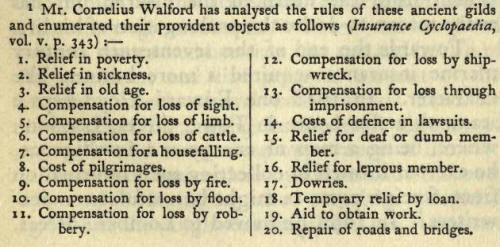

gilds made provision. These gilds existed at the earliest period to which

English history can be traced, and although they partook mainly of the

character of friendly societies, yet they had many features in common with

modern Assurance companies.

In a maritime country like England it was natural

that merchants and shipowners should desire some means of providing

against the loss of ships and cargo by storm, fire, or pirates, and so we

find that the earliest English law affecting this matter was "An Act

concerning Matters of Assurances among Merchants," passed in 1601. From

the preamble of this Act it is clear that the practice of underwriting the

safety of a vessel on a voyage had been long established.

Whereas it hath been time out of mind an usage among

merchants, both of this realm and of foreign nations, when they make any

great adventure, specially into remote parts, to give some consideration

of money to other persons, to have from them assurance made of their

goods, merchandises, ships, and things adventured, or some part thereof,

at such rates and in such sort as the parties assurers and the parties

assured can agree ; which course of dealing is commonly called a policy of

assurance, by means of which policies of assurance it cometh to pass, upon

the loss or perishing of any ship, there followeth not the loss or undoing

of any man, but the loss lighteth rather easily upon many than heavily

upon few, and rather upon them that adventure not than on those that do

adventure, etc. etc.

It will be noted that in this system, though the

safety of ship and cargo were assured, no provision was made against the

death of captain or crew. It is true that as early as the sixteenth

century private underwriters were found willing at exorbitant premiums to

take the risk of insuring travellers and others against death for brief

periods and during special undertakings, such as individual voyages or

even campaigns. Under this system, if such it may be called, a traveller

might deposit, say, £100 with a Jewish moneylender, who would bind himself

to pay him twice or thrice the amount on his safe return. Herein, if the

seed of modern life assurance may be recognised, the principles have come

to be reversed, for the underwriter no longer derives benefit from the

death of the insured, but has every reason to desire the prolongation of

his life.

Towards the end of the seventeenth century marine

insurance acquired a more business-like character. In 1688 one Edward

Lloyd kept a seamen's coffee-house in Tower Street, London where, being a

man of energy and intelligence, he exerted himself in collecting such

information from foreign ports as might be useful to underwriters. In 1692

he moved to Lombard Street, drawing many of his old seafaring customers

after him, who soon began to derive advantage in the new premises from

easy intercourse with merchants, consigners of goods, and other business

men. Lloyd's tavern became the recognised place for bargains about

freights, the sale or charter of ships, underwriting, and such-like

transactions. Maritime intelligence of all kinds was regularly posted up

for the information of customers, and in 1696 this enterprising man began

publishing such news three times a week under the title of Lloyd's News,

altered in 1726 to Lloyd's List, now the oldest periodical in the world

except the London Gazette. Such was the origin of the world-wide system

known as "Lloyd's," which was incorporated by Act of Parliament in 1871.

The value of property annually insured with underwriters certified by

Lloyd's now amounts to about £500,000,000.

The purchase of annuities by individuals from

corporations or other individuals became not uncommon in the sixteenth

century, and led to some very gross abuses. There was no fixed relation

recognised between the age and health of the annuitant and the price or

amount of the annuity. Each several contract was fixed by independent

bargaining in the total absence of any data whereon to base expectancy of

life.

Insurance against loss by fire, as shown above, was

included among the casualties provided against in the Anglo-Saxon gilds;

but it was not until after the Great Fire of London in 1666 that the

matter was taken up in any great commercial community, and in 1681 a

regular Fire Insurance Office was opened "at the backside of the Royal

Exchange." This was followed in 1696 by the formation of the "Hand-in-Hand

Contribution- ship, or Society for the Insurance of Houses and Goods from

Loss or Damage by Fire." Several other fire offices dating from about this

time foundered after a brief existence; but this one did not succumb, even

under the weight of its voluminous title, but, having extended its

operations to life assurance in 1836 and altered its name to the

Hand-in-Hand Fire and Life Office, it was merged in the Commercial Union

in 1905.

An attempt has been made in this brief sketch of the

earliest efforts at life assurance to show how little advance had been

made before the close of the seventeenth century to reduce those two

inimical agencies, Chance and Death, to the service of human society. Yet

it was during that century that busy intellects had been at work

collecting the material out of which has been built the great fabric of

Insurance which has proved of incalculable benefit to millions of human

families.

It is to the City Company of Parish Clerks [

Incorporated in A.D. 1232 under the title of the Brotherhood of St.

Nicholas.] that credit is due for laying the foundations whereon that

fabric has been reared. In the reign of Queen Elizabeth they began to

register accurately all baptisms and burials within the City of London. In

1592 they commenced publishing weekly statements, and from 1625 onwards

these returns were printed under the title of Bills of Mortality, whence,

for the first time, some material might be drawn for calculating the

chances and average duration of life among the population of London.

Coincident with the collection of these statistics

was the rise of that profound and versatile thinker, Blaise Pascal

(1623-1662), who, before he ceased to devote his faculties to scientific

research in order to concentrate them exclusively upon "the greatness and

the misery of man," applied them to studying the problem of Chance in an

attempt to elucidate its laws. Pascal's attention was first attracted to

what might have been deemed a barren field of enquiry by the Chevalier de

Mere, a noted gambler, who invited him to calculate probability in the

fall of the dice, with a view, of course, to a profitable system of play.

Pascal at once plunged deeply into the subject in correspondence with the

mathematician Pierre de Fermat, the result being the formulation of the

Theory of Probability, which immediately commanded widespread attention.

This unpromising beginning "was the first of a long series of problems,

destined to call into existence new methods of mathematical analysis, and

to render valuable service in the practical concerns of life." [Boole's

Laws of Thought, P. 243.]

The first to apply Pascal's doctrine of probability

to the ends of government and the benefit of society was the great Dutch

statesman and financier, Johan de Witt (1625-1672). The States-General

having resolved in 1671 to raise a fund by the issue of annuities, de Witt

presented a remarkably able report on the whole question, setting forth

the superior value of life annuities as compared with redeemable

annuities. [It appears from a passage in de Win's report that the

governments of Holland and West Friesland had been in the practice for

more than 150 years of raising funds by the sale of annuities, without any

correct estimate of the value of such annuities in relation to the health,

age, and other circumstances of the purchaser.] He had received a thorough

training in mathematics at school in Dordrecht and in the University of

Leyden, and applied the principles of that science to calculating the

probability of life. Basing his calculations on the statistics of

mortality recorded in the State Registers, he concluded that the

expectation of life in every man was the same in each six months between

the ages of 4 and 54. This he expressed by the figure I. From 54 to 64 the

probability in each six months was again equal, expressed by the fraction

2/3 from 64 to 74 was expressed by 1/2; and from 74 to 81 by 1/3.

Burgomaster Hudde added to this report his certificate to the effect that

he was satisfied that de Witt's calculations rested "on solid and

incontestable mathematical foundations." The report seems to have been

adopted by the States-General ; but no action followed, owing, probably,

in great part to the hostility of the Calvinist clergy, whose enmity de

Witt had incurred. In the following year it was de Witt's fate to afford

in his own person an instance of the uncertainty of life, and the

consequent advantage to the granter of a life annuity as compared with a

redeemable one, when he and his brother Cornelius were assassinated by the

mob at The Hague.

Nevertheless, the ball had been set rolling in the

right direction. Pascal's doctrine of probability, applied in the light of

such limited and imperfect statistics as could be drawn from the Bills of

Mortality, furnished a clue which led to the inauguration of a great

system. In 1686 there was published at Cambridge A Table for the

purchasing of Lives, certified by Isaac Newton as being, in his belief,

actuarially correct. In 1692 the English Parliament passed an Act for

raising one million sterling by the purchase of annuities, to carry on the

war against France. The price of such annuities was not fixed in any

relation to age or health. Annuities to the value of only £881,493 : 12: 2

having been purchased, a second Act was passed in the following year for

granting life annuities at 14 per cent to make up the balance of £118,506

: 7:10. The worthlessness of the imaginary valuations whereon these

annuities were based was exposed in the same year by Dr. Halley, who read

a paper before the Royal Society propounding an estimate of human

mortality drawn from five years' registry of births and deaths in the city

of Breslau. This, and the discussion which followed thereon, combined with

the action of the Government in advertising their scheme, drew public

attention forcibly to the subject. In 1699 the Mercers' Company of London

were persuaded by the Rev. Dr. Assheton (1641-1711) to carry into effect a

project which he had already laid in vain before the Corporation of the

Clergy and the Bank of England, for establishing a Life Assurance and

Annuity Association. The venture was favourably received, especially by

married citizens, who were enabled to purchase annuities for their widows

on a 30 per cent basis, and the subscription list filled rapidly. But it

was not long before Dr. Assheton's tables were found to be faulty ; the

annuities had to be lowered ; the society led a precarious existence for

six-and-forty years, until, in 1747, being hopelessly insolvent, a

petition was presented to Parliament for aid to extricate it from its

difficulties. The Mercers were able to plead in support of their appeal

the "benevolences" which they, in common with other City Companies, had

granted to needy Sovereigns in past centuries; it may have been that

consideration, or simply recognition of the merits of life assurance as an

institution, that disposed Parliament favourably to the suppliants; at all

events the prayer was granted; an Act was passed securing to "the

Commonalty of the Mystery of Mercers" £3000 per annum for thirty-five

years towards liquidating their liabilities to assured persons. Profiting

by the early experience of the Mercers' Company, the Bishop of Oxford and

Sir Thomas Allen founded the Amicable Insurance Society in 1706, and

obtained for its incorporation a Royal Charter. This society, based upon

the calculation of one death per annum in every twenty inhabitants of

London, charged uniform premiums, irrespective of age, sex, or health,

pooled its income and divided it each year among the representatives of

those who had died. It conducted a small, but sound, business till 1866,

when it was absorbed in the Norwich Union.

By the middle of the eighteenth century numberless

insurance schemes had been floated, nearly all of which failed ; and no

wonder, for it was not until the Equitable Society, founded on the mutual

principle in 1762 (and maintaining a vigorous existence at the present

day), adopted the tables prepared by their actuary, Mr. William Morgan,

[This remarkable man (1750-1833) was one of the true pioneers of life

assurance. Appointed assistant actuary to the Equitable in 1774, and

promoted to be actuary in 1775, it was to his sagacious insight into

principles that the Society owed its success among the wreck of

innumerable others. Morgan continued in office till 1830, when he retired

at the age of eighty, and was succeeded by his son Arthur, who, in turn,

retired in 1870, father and son having acted as actuaries to the Equitable

fur a period of ninety-six years.] that premiums were graduated on a scale

according to the age of the insured. 'While, therefore, the Mercers'

Company must be credited with being the authors of the first corporate

institution for the assurance of lives, to the Equitable Society must be

assigned the honour of being the true pioneers in the application of

scientific principles to the business. Moreover, the Equitable Society

possesses a special claim to the regard of members of the Scottish Widows'

Fund, inasmuch as our Society was framed on the model of the older

institution, and its constitution moulded under the advice of its actuary,

William Morgan. It was owing to the prosperity of the Equitable, which in

1809 had accumulated nearly four millions and a half of invested capital

and had more than eight millions of assurances, that the promoters of the

Scottish Widows' Fund were induced to take the bold step of adopting the

mutual system, under which the whole profits should be divided among the

policy-holders, instead of the proprietary system, which was almost

universal at that time among other assurance companies, and under which

the profits were assigned as dividend to those who subscribed the capital

of the concern. [Besides the Equitable, the London Life Assurance and the

Norwich Union had been established on the mutual system.]

In view of the keen competition now existing between

companies doing assurance business, the action of the Equitable in

promoting by counsel and encouragement the foundation of a rival

society—acting, in short, as a kind of foster- mother to it—may seem to

have been strangely unselfish and even quixotic; but the truth is that the

directorate of the Equitable were far from eager to extend their business

beyond the unprecedented limits it had attained in the early years of the

nineteenth century; they had from the first consistently declined to adopt

the agency system, being quite content with the grist that came to their

mill in London ; wherefore they could regard with equanimity and approval

the foundation in the northern capital of a counterpart to their own

institution. Nevertheless, members of the Scottish Widows' Fund should

bear in grateful remembrance how much their society owed in its infancy to

the Equitable and its actuary William Morgan.

|