|

(1) CONTRIBUTIONS.

(a)

Contribution Card.

He

must provide himself with a Contribution Card, so that contributions can

be paid by means of Health Insurance stamps. He must present the card to

his employer when the latter asks for it. As soon as the period covered

by the card has elapsed, he must, after signing- it in the

proper place, hand it over to his Society. If he is not a member of an

Approved Society, he must hand it in at any Post Office.

(b)

Insurance Book.

After

handing in his first contribution card, he should receive an Insurance

Book bearing the name of the Approved Society and the member’s number,

and his name, address, nationality, and occupation. In the space

provided in the second page of the cover, the insured person must sign

his name immediately on receiving the book. The book will show the

number of contributions paid by means of stamps on the contribution card

which he has surrendered. He should see that the number is correctly

entered and the entry initialled on behalf of the Society.

If

his card for any period is not fully stamped, he may complete the

stamping himself. There may be blanks because he has been out of work.

If he has been out of work because of illness, his Society will not

count arrears against him for that period. If, however, he has not been

ill but has been merely unemployed, arrears will be counted unless he

stamps his card himself. He need only stamp the card with a stamp of the

value of his own contribution, i.e., in most cases Id.

The

employer is bound to return to the insured person any card in his

possession (a) when the man leaves his employment; (b) when the period

covered by the card is up, or within six days thereafter; and (c) within

forty-eight hours after the insured person requests it.

When

an insured person leaves an employment, he must ask his employer for the

return of his card.

(2) JOINING A SOCIETY.

Every

insured person should join an Approved Society. If he does not join a

Society, he cannot get more in benefits than the value of his

contributions, plus the contribution of the State.

A

list of Approved Societies can be consulted at any Post Office. To join

a Society he must fill up an Application Form which will be supplied by

the Agent or Secretary of the Society or Branch he proposes to join.

He

must be careful to state on this form only what is strictly accurate, as

the Application forms the basis of the contract between him and the

Society. A few days after filling up the Form and handing it in, he

should, if he has received no intimation on the subject, ascertain

whether the Society has accepted or rejected his application. If

rejected, he should try another Society.

He

should take a note of the name of his Society, the name and address of

the Secretary, and, if he has joined through a Branch, the name and

address of the Branch and its Secretary. If he has joined through an

Agent, he should note the name and address of the Agent, and also the

address of the local office of the Society. He should keep a note of his

number in the Society. This is given in the Insurance Book, which

should, of course, be always carefully preserved. In communicating with

his Society on any question he should always quote his number. He should

get a copy of the rules of the Society, and make himself acquainted with

his rights and duties under them.

(3) BENEFITS.

Medical Benefit.

To

eet medical attendance and treatment he should choose a doctor. A list

of doctors on the panel may be consulted at any Post Office. He must

fill up a form applying for the doctor of his choice. This form may be

obtained from almost every chemist, or from the doctor himself. Officers

of Customs and Excise and in some cases also the Approved Society can

supply the forms. If the doctor accepts him, he will be on his list

until the end of the current medical year. Towards the end of that time

he will have an opportunity of changing to another doctor if he desires.

Change of residence from

one Insurance Committee area to another.

If an

insured person goes from one Insurance Committee area to another, i.e.,

from one large town to another, or from one county to another, he must

take steps to provide himself with medical benefit in the district to

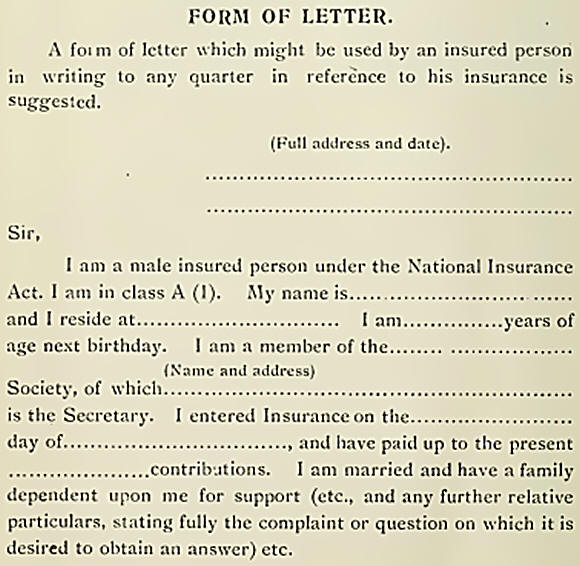

-v\hich he goes. He must write a letter or a postcard to the Clerk to

the Insurance Committee of the area where he goes to reside, and ask

that arrangements be made to provide him with medical benefit.

Address of Clerk to

Insurance Committee.

He

can ascertain the address of the Clerk to the Insurance Committee by

inquiry at any Post Office. In writing to the Clerk he must state his

full name and address, the full name and address of his Society, the

address at which he formerly resided, and he must forward his medical

ticket.

Change of residence

within an Insurance Committee Area.

If he

removes from one part of a town to another, or if he removes from one

part of a county to another, remaining in the same Insurance Committee

area, he can obtain a transfer from the list of his present doctor to

the list of another doctor more conveniently situated to his new

address. To do this, he must write, as before, to the Clerk to the

Insurance Committee, giving full particulars and forwarding his medical

ticket.

Complaints about medical

attendance and treatment.

If an

insured person has any complaint to make with reference to his treatment

by his doctor, he should write to the Clerk to the Insurance Committee,

who will enquire into the matter. As before, he must be particular to

give full information in regard to himself and his complaint.

(4) SANATORIUM BENEFIT.

If

the insured person is suffering from consumption, he can apply for

sanatorium benefit. This application must be made to the Clerk to the

Insurance Committee of the area where he resides, and a form for the

purpose may be obtained at the Insurance Committee office.

(5) SICKNESS BENEFIT.

(a)

Qualification.

To be

qualified for sickness benefit an insured person must have been insured

for twenty-six weeks, and have at least twenty-six weekly contributions

paid. Before he can get sickness benefit he must be totally

incapacitated from work, and he must be able to prove to his Society

that he is totally incapacitated.

(b)

Procedure for claiming sickness benefit.

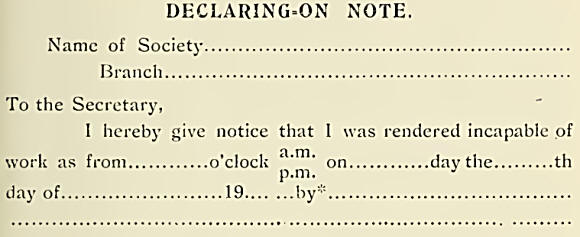

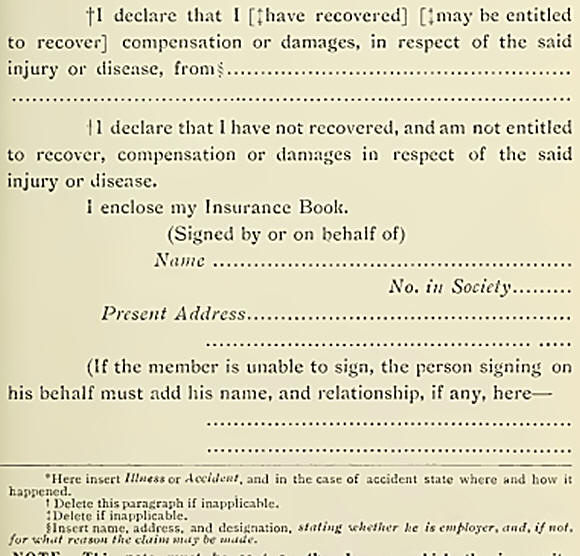

He

must make a formal claim in writing on a Declaring-on-Form, which the

Secretary or Agent of his Society will give him. This form must be

carefully filled up and handed in together with a medical certificate

obtained from his doctor. The form of Declaring--on Note will usually be

something- like the following :—

DECLARING=OFF NOTE.

Name of Society

(Branch)............................................

I

hereby declare that 1 am now again capable of work, and declare off the

funds of the Society. 1 also declare that I remained incapable of work

till..........................................

{date),

[and claim benefit in accordance with the Society’s rules for the days

that have elapsed since 1 last received benefit].

I

have not received any compensation or damages in respect of this

illness.

Signature of Member....................................

Date....................................

(c)

Points to be

remembered.

(1)

That he is not entitled to sickness benefit unless his illness exceeds

three days.

(2)

That the Society will require a certificate to cover the three waiting

days for which he does not get payment.

(3)

That further certificates of continued incapacity will be required.

(4)

That when in receipt of sickness benefit he must observe the rule of his

Society relating to conduct during sickness. This rule will provide that

he must not be out of doors after certain hours, and, in addition to

other matters, that he must obey the instructions of the doctor

attending- him.

(5)

That if the rules are not observed, the Society may impose penalties in

the shape of fines.

(6)

There are other conditions laid down in the rules with regard to

sickness benefit with which he should make himself acquainted.

(6) MATERNITY BENEFIT.

(a) Husband

compulsorily insured but not the wife.

If a

man who is compulsorily insured is married, he will get a maternity

benefit payment of 30s. on the confinement of his wife, if he has been

twenty-six weeks insured and twenty-six weekly contributions have been

paid. He must satisfy the Society that the claim is good. He must, if

required, prove by the production of a marriage certificate, or

otherwise, that the woman is his wife, and that the confinement has

taken place. He must fill up the form of claim to be obtained from his

Society Secretary or Agent, and he must get the signatures required on

the form from the doctor or the nurse who attends the confinement.

The

Society need not pay him the whole of the 30s. It may engage the doctor

or the nurse and pay the necessary fees. The balance may be handed over

to the insured person in cash, or the Society might dispose of it in the

provision of food or other necessaries for the mother and child.

(b) Wife

compulsorily insured but not the husband.

The

wife in this case is entitled to two payments of 30s., if she has been

insured for twenty-six weeks, and twenty-six weekly contributions have

been paid. She must not, however, go out to work for wages for at least

four weeks after confinement.

(c) Both

insured.

Here

the man must claim maternity benefit from his Society and the woman will

also claim maternity benefit from her Society, and must abstain from

working for wages for at least four weeks after confinement.

Careful note must be made of the provisions of the Amending Act with

regard to maternity benefit.

(7) ARREARS.

Arrears, if allowed to accumulate, will affect benefits. The insured

person should therefore do his utmost to keep his contributions as much

up-to-date as possible in spite of periods of unemployment. While

unemployed he need only pay his own share of the contributions. In order

to qualify for sickness and disablement benefit, he should remember that

twenty-six contributions are required for the first and a hundred and

four contributions for the second. It is very much in his interest,

therefore, to get these contributions paid at the earliest possible

date.

(8) EXCESSIVE SICKNESS

&

DEFICITS IN SOCIETIES.

Every

member of a Society should remember that he has a personal interest in

saving and safeguarding the funds of the Society. If the claims are too

heavy, the Society may not be able, after a valuation, to go on paying

full benefits, i.e., it may have a deficit. It should be noted that a

man who leaves a Society in deficit carries a proportion of the deficit

with him, and will be subject to the same reduction of benefit as would

have applied had he remained in his old Society. The State does not make

good the deficit of any Society.

(9) INSURED PERSON IN

HOSPITAL.

When

the insured person is in hospital he does not get a direct payment of

benefit. If he has any persons dependent on his earnings his Society

must pay or apply the benefit to relieve or maintain them. If he has no

dependants and is getting sanatorium benefit, the amount of the benefit

will go to the Insurance Committee If he has no dependants and the

Society has agreed with the hospital or other institution, the amount

may be paid to the hospital towards his maintenance therein. Any balance

remaining will go to the insured person, after leaving the institution,

in cash.

(10) CHANGES OF

RESIDENCE.

If an

insured person changes his residence, he must inform" his Society and

make the necessary alterations on his Contribution Card and Insurance

Book. What he must do in regard to medical benefit is noted above.

If he

goes abroad permanently, it is only if he has been a deposit contributor

that he will be entitled to any refund of his contributions. He should,

however, certainly keep in touch with his Society at home, as

arrangements may be made whereby he may benefit by his insurance in this

country.

(11) TRANSFERS.

(a) From

Deposit Insurance to Approved Society.

All

that is required here is to get filled up the necessary form for joining

the Society. The Society will take steps to arrange the transfer from

the deposit contributors’ class.

(b) From one

Society to another.

The

Society which lie wants to join will give him an application form. When

this has been filled up he will get in exchange a form agreeing to

accept him as a member, if the old Society agrees to his withdrawal. The

new Society will also give him a form asking the old Society to give its

consent. He must fill up and forward this form to his old Society and

await a reply. His old Society is entitled, on reasonable grounds, to

withhold consent to his withdrawal. If he is told that consent is given,

his transfer will be arranged between

the

two Societies. If the old Society refuses to consent to his withdrawal,

he will remain a member of that Society. He may, however, refuse to

accept the decision of the old Society and appeal from it in accordance

with the Society’s rules as to disputes. He can bring this appeal in the

last instance to the Commissioners. .

(13) BIRTH CERTIFICATES

AND MARRIAGE CERTIFICATES.

These

can be obtained cheaply, where they are required for the purposes of the

National Insurance Act, the former for Gd., and the latter for Is.

Application should be made .at the nearest office of the Registrar of

Births, Marriages and Deaths.

|