|

Do not steal. Do not covet anything that belongs to your neighbour.

… Do not take advantage of a widow or an orphan. Do not ill-treat

aliens or refugees, or oppress them. … Do not use dishonest standards

when measuring length, weight or quantity. Use honest scales and honest

weights. … If you lend money to one who is needy,

do not be like a money-lender; charge him no interest. … Do not defraud

your neighbour or rob him. Do not hold back the wages of a hired man. …

When you harvest the land, do not reap to the very edges of the fields,

or gather the left-over gleanings. Do not pick up fallen grapes in your

vineyards. Leave them, and the gleanings, for the poor and the alien. …

Do not lend money at interest to the poor, or sell them food at a

profit. Land must not be sold permanently, it must be returned in the

year of jubilee. The fiftieth year is to be the year of jubilee.

Mortgaged land must be returned. Indentured servants must be set

free.*

The Laws of Moses (selected),

from Exodus and Leviticus, NIV translation

A final word to the

arrogant rich : Take some lessons in lament ! You’ll need buckets for

the tears when the crash comes upon you. Your money is corrupt and your

fine clothes stink. Your greedy luxuries are a cancer in your gut,

destroying your life from within. You thought you were piling up

wealth. What you’ve piled up is judgment.

The workers you’ve

exploited and cheated cry out for justice. … You’ve looted the earth and

lived it up. But all you have to show for it is a fatter than usual

corpse. In fact what you’ve done is condemn and murder perfectly good

persons who had to take it, being vulnerable and

defenceless.*

The Epistle of James, paraphrased, from

The Message, by Petersen

I saw an angel come

down from heaven with great authority; and the earth grew bright with

his splendour. He gave a mighty shout, “Babylon the great is fallen;

she is become a den of demons, a haunt of devils, and every kind of evil

spirit. For all the nations have drunk the fatal wine of her intense

immorality. The rulers of earth enjoyed themselves with her, and

businessmen throughout the world have grown rich from all her luxurious

living. … World leaders who took part in her immoral acts, and

enjoyed her favours, will mourn for her as they see the smoke rising

from her charred remains. They will stand far off, trembling with fear,

and crying, “Alas, Babylon, that mighty city ! In one moment her

judgment fell.” The merchants of earth will weep and mourn for her, for

there is no one left to buy their goods. Businessmen who became wealthy

by selling her produce shall stand at a distance, fearing danger to

themselves, weeping and crying, “Alas, that great city, so beautiful, …

decked with gold and pearls ! In one moment, all the wealth of the city

is gone.”

Ship

owners, captains and crews of merchant vessels will stand a long way off

crying as they watch the smoke ascend, “Where in all the world is

another city like this ?” They will throw dust on their heads in their

sorrow and say, “Alas, alas for that great city ! She made us rich from

her great wealth. And now, in a single hour, all is gone”.*

The Revelation, by the apostle John,

paraphrased, from The Living Bible

The rise of capitalism

and global banking systems in the last two to three centuries, has given

enormous power to the individuals and organizations that own or control

land and financial assets. This power has been buttressed and given

both legal and moral support although the actual manner in which the

land and assets were acquired may have been dubious in the extreme, and

based on little more than conquest, pillage, exploitation, patronage,

corruption or manipulation. An interesting aspect to the moral support

for the whole monetary system is how it has assumed or acquired a

religious basis as if it was founded on divine revelation. This stands

in contrast to the economic arrangements that all the great religions

developed and implemented (to greater or lesser degrees), to ensure that

indebtedness did not extend for generations, and that there was relief

and support for the poor and destitute. The pre-Christian era Hebrew

prophets were fierce in their

denunciation of unrestrained and unjust exploitation, as is the whole

teaching of Christ on wealth and its use. But today’s right-wing

Christian churches and organizations, particularly in the USA, see the

maximization of profit and the accumulation of wealth as a Christian

duty. Conversely, poverty and economic disenfranchisement are regarded

as if they were the fault of the poor themselves.

Dollars, Pounds, Euros and Yen, - symbols

of the world’s Currencies

A former Wall Street analyst and President of the Institute

for the Study of Long-term Economic Trends in New York has written,

“Today’s financially oriented economies undermine the ethic of mutual

aid, societal safety nets, and policies that would alleviate debt

burdens. This is the outcome of a 5,000 year process, in which the

privatization of land, credit and industry, has permitted creditors to

assert their rights over the rest of society”

(above all other moral and

social rights). [Dr

Michael Hudson; (editor), Debt and Economic Renewal]

Wall street, America’s financial

centre

The process of the

accumulation of wealth and power by a few at the expense of the many,

has periodically resulted in enormous social upheavals and bloody

conflicts such as the French and Mexican Revolutions, and the liberation

wars of African and Asian territories. Further conflicts are inevitable

if present trends continue. The World Bank reports highest rates of

population growth (2.2% and 2.6% respectively) are occurring in parts of

sub-Saharan and north Africa, and the Middle East where political

turmoil, high unemployment, low economic growth, and massive export of

irreplaceable and depleting natural resources are all presently

occurring. [David

Smiley, Macquarie University, Macro-parasitism and the design of

remedial programs]

Since the days of Adam

Smith, market forces have recognized as a major, if not the major

element in determining the economic performance of nations and

companies. Some have elevated the market to a position of reverence as

if it was part of the immutable laws of the universe. They seem to

think that the market can do wrong. But no less a student of the global

markets as George Soros, has identified their weaknesses and limitations

: “Markets are designed to facilitate the free exchange of goods and

services among willing participants, but are not capable on their own,

of taking care of collective needs. Nor are they competent to ensure

social justice. These “public goods” can only be provided by a

political process.” [Improving

the World Order, George Soros, in The Bubble of American Supremacy]

To me it has always seemed that allowing the market to rule above

all other human or environmental concerns, represents a brazen return to

the morality of the slave trade, the

casino, or the

whorehouse. Of course, even the most ardent monetarist makes

exceptions for things like narcotic drugs or nuclear weapons.

George Soros, financier, currency

speculator, and democracy advocate

Banking and Financial

Systems

Our capitalist system

is based on the control and use of money and assets by banks and

financial houses which in many ways wield more power than do elected

governments. The way banks ‘create’ money, and the freedom they have to

charge for this created money, is one of the wonders of this modern

economic world. Banks ‘create’ money by lending sums far beyond the

deposits or assets in hand. Every new

loan they issue permits

them to lend more money. And the banks charge substantial interest on

the loans they issue on the basis of their remit to issue credit beyond

the immediate reserves they possess. A major financial dealer cum

politician has said, “Let me control a nation’s currency, and I won’t

care who runs the government”.

Furthermore, the banks

are lenders that must be paid before any other creditors. During the

dark days of the demise of Scotland’s fishing industry, banks had to be

paid from each vessel’s trip earnings before the suppliers of fuel, ice

and stores, and before the crew got any wages. The banks gradually

assumed ownership of boats and their assets, and even of ‘quotas’ which

were little more than the right to catch fish in the future. How can

you ‘own’ a fish that is swimming somewhere in the ocean, or own huge

amounts of fish that are not even born yet? The same process occurred

in American agriculture, and the tentacles of bank ownership and control

continue to reach out and claim possession of land, businesses and

assets that no one in the bank worked to create, except that it may have

lent money to the venture, - money that itself was created out of

nothing!

Avarice. This is how Medieval scholars

and ancient Hebrews thought of charging interest on loans of money.

Our modern banking

systems seem to me like an enormous parasite that sucks the wealth and

assets from individuals, businesses, communities, and countries.

Governments all over the world appear to become more and more deeply in

debt to national and global banks. Why should that be ? What right

does a banking institution have to rake in excessive profits and yet

share none of the risks of its borrowers ? Some will protest that they

do, and that some banks have suffered losses. My own impression as a

total layman in the subject is that investors certainly suffer losses,

especially the small investors and pensioners, and some small banks and

peripheral financial organizations suffer losses. But the really big

financial houses appear to gain as more and more people, companies and

governments have their futures mortgaged to them. Publicly, through

World Bank loans and schemes like private finance initiatives, we are

putting our children and our children’s children in debt for

generations. How can this whole gadarene slide into the shackles of

endless debt be ended or reversed?

We need a cleansing

apparatus that would put things to right every few decades. The ancient

Hebrews had such a righting mechanism in the “Year of Jubilee”

instituted under the Law of Moses. It was probably put into practice

only rarely and incompletely, but it was designed to prevent perpetual

indebtedness and bondage. Every fifty years, all unpaid debts had to be

wiped off the books. Just think what such an arrangement would do for

any country or any society!

Serious consideration

is now being given to writing off the external debt of the poorest

countries in the world. Truth be told, in implementing such a policy

the lending countries are just giving something to themselves since the

debtor state can barely pay, and once in a condition of financial

liquidity, would resume purchasing goods from the lender. But some

solution needs to be found to control the corrupt leaders of so many

poor countries, and to limit the power of multi-nationals and arms

suppliers who would be only too ready to take advantage of the

continents new-found liquidity.

The Financial Crisis

From 2008 the world has witnessed an unprecedented crisis in

national banks and global financial systems. Governments have bailed

out banks at taxpayers’ expense while the bankers who gambled their

country’s assets in the global casino to obtain ever larger bonuses and

apparent profits, have largely been rewarded. None have been taken to

court or jailed, though in one case the head of the Royal Bank of

Scotland who oversaw an unprecedented loss of £ 24 billion in 2008 was

stripped of his knighthood in January 2012. But he still retained his

massive £ 12 million pension pot.

The whole Gaderene slide into massive worldwide debt began

with the sub-prime mortgages in the USA. Money was lent to unqualified

borrowers, and then interest rates raised till thousands defaulted and

had their houses taken from them. Meantime the US banks hawked these

worthless mortgages and loans around the world by mixing them up in

financial instruments which were sliced salami style so those foolish

enough to acquire them hadn’t a clue about their value, (they were

worthless), and no-one bank seemed legally responsible to pay for the

losses when the whole house of cards collapsed. But astonishingly the

thousands of intelligent bankers and financial experts in America and

Europe remained blind to the impacts of their mismanagement as they saw

only more and more obscene bonuses coming their way.

The bankruptcy of the large American bank Lehman Brothers on

“black Monday”, September 15 2008 was one of the biggest in a series of

bank failures and rescues by panicking governments in the face of a

tsunami wave of financial losses. The British government had to

nationalize Northern Rock on 12 February 2008 and Bradford and Bingley

on 29th September of that year. Then on October 13 it had to

pump £ 37 billion into RBS, HBOS, and Lloyds TSB. Iceland’s Landsbank

fell into bankruptcy on December 9th, effectively bankrupting

that small country.

The UK bailout of its financial giants RBS and Lloyds TSB is

now estimated to cost British taxpayers up to £ 1.5 trillion. That is £

1,500 billion, - £ 25,000 for every man woman and child in the country,

pensioners, students, and low-paid alike. The figures are astounding,

and probably beyond most ordinary folk’s ability to comprehend. The

cost will impact on people over the next few years in reduced health

services and social benefits, higher taxes, and more costly college fees

which will put university places beyond the reach of young people except

those privileged to have wealthy parents.

In the Eurozone of 25 countries, (Jan, 2012) 14 had public

debts of more than 60 % of GDP. Greece, the ‘basket case’ of the EU had

debts amounting to 142 % of GDP. Italy had a debt to GDP ratio of 119

%. In Belgium and Ireland it was 96 %. In Portugal it was 93 %. The

ECB, European Central Bank, said in December 2011 that it would provide

$ 638 billion ( Euro 489 billion) to 500 banks. Twelve Italian banks

borrowed $ 143 billion (Euro 116 billion.

The response of the EU

and Angela Merkel in particular is to save the Euro at all costs. That

currency only came into being in 2002. Ten years later it is on the

brink of collapse. But it was primarily a political and not a financial

or economic venture. And so the chief politicians of the EU want to

save it. They have demonstrated by their actions that they are quite

prepared to impose technocratic rulers on to Euro states, destroying

what is left of their sovereignty and democracy. But that might be

expected from the lady who was an ardent communist and a privileged

citizen in the DDR (East Germany) before reunification. Her father Horst

Kasner was a Lutheran Pastor who moved from West Germany to the DDR just

after Angela was born in 1954, and was treated like a VIP by the East

German government and allowed many privileges. He was a constant critic

of the West. Some who know Chancellor Merkel well claim that she is

neither democratic nor libertarian, and is much more comfortable with

the apparatus of a strong and dictatorial state. Is that where she will

take the EU ?

The Head of Europe’s

major bank, Deutsche Bank, and of the Institute of International

Finance, Dr Josef Ackerman, gave the world and his fellow bankers this

stark warning over the BBC in early 2012. “We have a social

responsibility to be philanthropic . . . if this inequality in income

and wealth distribution increases, . . . we may have a social

time-bomb ticking.”

That time bomb could

have unthinkable consequences for most western countries.

The World Bank and

International Development

I have very mixed

feelings about the World Bank and its affiliates, the Asian Development

Bank and the African Development Bank. I say that having worked for

these organizations much of the time the past 25 years. First of all,

it should be borne in mind that if you describe World Bank loans as

“aid”, - it is aid with strings attached, and aid that is very much in

the interests of the lending parties. Most World Bank money is actually

spent on goods and services obtained from its member countries. A

smaller percentage of Bank project money is spent inside the recipient

country, - and, - please note, - since the borrowing country has to

contribute the local currency costs of the project, the amount spent

in-country in most cases equals the amount they have contributed to the

project.

Headquarters of the World Bank,

Washington DC, close to the State Department and the White House.

The loans made by the

World Bank and its affiliates are extremely bureaucratic in their design

and administration, and can be subject to seemingly mindless nit-picking

and arbitrary requirements, often to satisfy internal dogma rather than

assist the borrowing state which is regarded with a surprising lack of

genuine respect.

Some will protest that

WB loans are very cheap. They carry low interest, and often involve a

grace period before repayment commences. That is true only for the most

preferential loans that are for social and environmental investments.

Rates may be as low as one per cent, and the grace period may be 5

years. However one must remember that they are in foreign currency,

usually dollars, and that means an automatic interest rate for the

borrower as the local currency declines in value against the dollar.

Other loans carry rates of around four to six-and-a-half per cent, and

involve conditions that may not be in the borrowers’ best interests.

World Bank loans come

with ‘strings attached’, and governments have to conform to Bank ideas

on the direction of development investments, as well as on how their

economies should be managed. The attempts to impose fiscal policies on

poor countries in Africa have been extremely punitive on the very

section of the population that the loans are meant to help. Bank

officials are for ever trying to get developing country governments to

reduce public sector employment. But this is tackled in a manner that

often reduces the little bit of development that governments can

stimulate. One practical example might suffice.

During the 1970’s under

a UNDP country programme, I assisted the Republic of Indonesia to

establish a nation-wide fishery extension service. Technology units and

extension centres were constructed and put into operation in all 26

provinces of the country. Hundreds of

technical staff were trained to levels of competency in gear and

methods, navigation and seamanship, boat-building and marine mechanics,

fish processing, refrigeration, quality control, and the farming of fish

in fresh, brackish and marine waters. The technical officers were

posted to the field stations in every part of the country and for the

next ten years, the national fisheries grew and prospered. Then along

came a World Bank official (an Englishman), in 1990 who advised the

government to reduce its public sector employees. He said it was a

waste of money to have separate extension services for fisheries as well

as agriculture. Foolishly (as is now admitted), the government

succumbed and scrapped the whole fishery extension service. Thereafter,

all a fisherman or fish farmer could get in the way of technical

assistance was an occasional visit by an agriculture officer who was

trained in the production of rice, livestock or coconuts. It was small

wonder then that within a few years, an imbalance took place in the

harvesting of coastal fish stocks, and mismanagement of the fish farm

sector led to virus disease outbreaks that were to cost hundreds of

millions of dollars and cause several bankruptcies and non-repayment of

bank loans. All that to satisfy World Bank monetary ideology!

Photos above : poor artisanal fishers in

Arabia, Africa, Sri Lanka and India. There are over 20 million of them

in the world, but they suffer continually from monetarist and

globalisation policies imposed on their governments by the World Bank

and multinational business. In Indonesia where hundreds of technicians,

instructors and extension workers had been trained, and centres

established in all 29 Provinces, the World Bank demanded the Government

close that service and dismiss the employees, to economise on public

expenditure in a nation that had over 3.5 million fishermen and fish

farmers, producing much needed fish protein food for its then 150

million population.

I was

once asked to address a seminar of government officials in the

Philippines on the subject of “how to obtain a World Bank loan”. I’m

afraid I disappointed the whole audience by stating at the commencement

that in most cases, developing countries needed World Bank Loans, like

they needed a ‘hole in the head’. The truth is that far too much Bank

aid is spent on projects the country could well do without. But right

down through the whole government apparatus there is a belief that all

the bureaucrats will benefit in some way from handling and spending the

millions involved. There are groups of projects that are attractive to

government personnel since they are easy to justify, and the Banks

appear to be only to willing to lend money for those infrastructure /

energy projects.

This

applies particularly to the damming of rivers for irrigation and power

generation purposes. Some early ventures of this nature may have been

good and beneficial in the long run. But soon they are seen as money

making projects by central and regional officials, and you then see a

series of dams being constructed with little strategic thought, and

usually with tragic consequences for the environment. This is happening

all over the world. It is happening in Africa, - Nigeria being a prime

example. It is happening in Indo-China where dams planned for the

Mekong river threaten the future of agriculture and fisheries

downstream. It has happened with disastrous results in central Asia

where canals rather than dams have drained the Amu Darya river and dried

up the former inland sea of Aral.

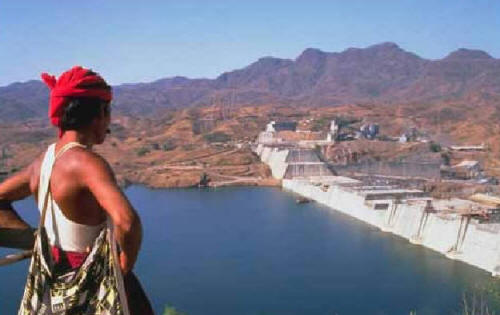

Dams are a favourite investment for

international banks. This one is in India.

Itaipu dam, Brazil

Some

will ask, “but aren’t the Banks reluctant to lend money for such

projects”? The answer is yes and no. They have huge environmental

departments that are supposed to warn them against this kind of

intervention. But the Banks are in the business of lending money. Few

lay persons realise that the World Bank and its affiliates are

money-making organisations. They make a healthy profit on their

operations. The last thing they want to happen is for countries to stop

borrowing money from them. And they love the big capital-intensive

projects like those for seaports, airports, cement plants, dams and

highways. The kind of projects they don’t like, and the ones the Banks

are poorest at implementing are investments aimed at benefiting hundreds

of thousands of poor rural people. Few of these poverty-alleviation

projects ever succeed in achieving their objectives.

President Allende of Chile. He was

democratically elected, but was overthrown by General Pinochet with U.S.

support. Pinochet became a brutal dictator.

The

loans are often political. If anyone doubts this they should look at

the way the World Bank shovelled huge sums of money into Chile to

support the Pinochet regime after Allende was overthrown, and how they

have no wish to know countries like Cuba. But that is probably just as

well for Cuba. I was assisting a World Bank project in a country I

shall not name, on what was intended to be a $ 100 million investment in

higher education. It was a rather dry, conservative, long-time staff

member of the Bank who remarked half-way through the project, that its

real purpose was political security, not education. Most of the money

was to go into new well-fenced university campuses located far away from

urban centres, whether the institutes needed them or not. Very little

was to go into staff development, even less into laboratory equipment,

and practically nothing into library materials and course textbooks.

The priorities were all upside down. The officer pointed out that in

his opinion the government wanted to secure college campuses and isolate

troublesome students before political protests became widespread. So

the Bank happily lent money to make this physically possible, and

dressed it up as investment in education. But the officer who

identified the real nature of the project just shrugged his shoulders

and said that he had joined the Bank as an idealistic economist, but had

sold his soul to the organisation within the first two years.

United

States governments and legislators often criticise the U.N. Agencies and

the international banks as being over-bureaucratic and wasteful. One

gets the feeling that such pronouncements are made mainly for internal

consumption, to please an electorate that imagines that their tax

dollars are being given away without thought to corrupt, lazy

foreigners. That would seem to be a popular impression. In this area

as in several others, the American public is ignorant of several

aspects. First, of the rich nations, although it is the largest single

contributor to the U.N., it gives a smaller percentage of GNP to aid,

than any of the others. In contrast it gives from 30 to 100 times its

aid amount, to the military and to weapons of mass destruction.

A

second misconception is that the US has no control over UN budgets, and

has difficulty getting detailed information on where the money goes.

The lie to this idea is that the Head of Finance in each of the UN

organisations and agencies, is an American officer ! So, if the

Americans don’t know where the money goes, - no-one does ! The US has

had a strange propensity for appointing its most belligerent military

supporters to head the World Bank. President Johnson did this with

Robert Macnamara, and President Bush has just done so with Paul

Wolfowitz. The one masterminded the huge military expenditure in

Vietnam, and the other, that in Iraq. What kind of a message does this

send to poor, vulnerable peoples ? What compassion if any have those

doctors of death ever shown to suffering humanity?

The

other factor that needs to be borne in mind is that almost no country

ever defaults on a World Bank Loan. That is not wholly true as we have

the case of Argentina at present, and a couple of pathetic basket cases

in Africa, but the few who defaulted before were the poorest of the

poor, and the loans they were unable to repay were modest. Whether a

Bank loan is successful or not, it has to be repaid. I have often told

officials abroad that if they were to offer private banks the same

guarantees and security of repayment, that they give the World Bank, -

they could get extremely preferential rates. This in effect is what

Malaysia has done with good results.

Some will ask about the

corruption involved in the use of international loans, and sometimes

talk foolishly as if the money was handed over in cash, with no

accountability required. What actually happens in most cases is that

the lowly paid government staff members see aid loan expenditures as an

opportunity to supplement their small salaries. In most Asian countries,

this is done in a manner that has been almost formalized. The

contractors or suppliers of equipment are expected to pay a ‘commission’

to the government. I have little inside information, but my guess is

that the payment can be as high as 5 or even 10 per cent of the total

cost, though I have heard of it having to be fifty per cent or more in

Africa. The more corrupt the country, the more, and the larger share of

the ‘commissions’ goes to the greedy persons at the top. In Asia, the

money is distributed around all of the staff members of the Department

concerned, according to rank.

So, when officials of

developing countries put their hands on their hearts and told me they

were not guilty of any corruption, what they really meant was that if

and when a ‘commission’ came their way, they shared it with all others

in the service, according to the unwritten code for such payments. To

confirm this, I recall the case of a village head I knew (the lowest

civil authority rank), who was put in jail. I asked why and was told it

was for corruption as he had taken bribes from businessmen. When I

responded that all officials in the country took such bribes, the

response was, “yes, but he did not share the money with the other

local government officials”.

Do not foreign

consultants like myself, sometimes protest or object to the practice ?

Yes, the answer is that many do. But the response to them by national

officials generally runs along these lines : “What are you

complaining about ? You are a highly paid consultant. We are poorly

paid officials. And this money is not your money. It is money our

country has borrowed and which it will repay in full, with interest. So

what business is it of yours what we do with our money?”.

Now,

what about the current case of Argentina (in 2004) ? Successive

governments led the country into colossal levels of debt, aided and

abetted by wealthy people, financial speculators, and big businesses,

that bled the country of foreign currency and charged poor Argentineans

in U.S. dollars for rentals and contracts. Now those poor Argentinean

workers are being asked to repay the World Bank and other lenders, $ 132

billion, while those individuals and corporations that robbed the

country get off “Scot-free”. So the current President of Argentina,

Nestor Kirchner, has said in effect, “No !, the people need food and

jobs before the bankers start to be repaid, if ever”. I must admit

to strong sympathies with his attitude.

However, as serious as Argentina’s debts seemed to be at the time, -

they are dwarfed by the colossal amounts of sovereign and private debt

that has overwhelmed Greece, and several other EU states. Argentina

could at least take matters into its own hands and by devaluation and

other means get its finances and economy under some control. But Greece

and othe EU states do not have that option. The Eurozone (said William

Hague, UK’s Foreign Secretary), - is a burning building with no exits.

Why

should the money-lender not share in the risks of the business ? When a

business fails, the owner suffers, the workers suffer, the customers

suffer, - but rarely does the money-lender suffer. Banks usually have

priority over other creditors. Surprisingly, in the case of Argentina,

the international banks and the USA have accepted for now the

President’s fiscal priorities, and are giving him time to attend to the

more urgent needs. President Kirchner wants to create a million jobs,

and to ensure that there will be food for all, including the poorest.

In fact a lot of the former debt is now held by nationals and local

companies in the form of bonds that are worth less than half their

original value.

An unholy alliance

The global lending

business centred on the World Bank and its affilliates, was established

after WW II in an attempt to provide low-cost finance to poor countries

that needed to re-build or develop their economies so they could feed,

educate and care for their peoples. Few would argue against the

sentiments that led to the World Bank and its U.N. affiliates being

established. But the World Bank has now become an American institution,

and its lending programme primarily designed to assist U.S. business and

even become a tool of American foreign policy. Global observers, much

more experienced and knowledgable than I, have described how the process

worked, over the past four decades and more.

Bretton Woods where the post-war

conference took place that set up the IMF and the World Bank

Inside the Bretton Woods conference

The military-industrial

complex whose growing powers were apparent to President Eisenhower 45

years ago, has developed into a monster that could scarcely have been

imagined back then. The petroleum industry is now a major element in

that enormous cartel. Corporations like Halliburton, Bechtel, and the

Texan oil giants, are among the global bloodsuckers that devour the

world’s natural wealth.

Some believe that

Robert McNamara’s greatest and most sinister contribution to history,

was not his ruthless accountants direction of the war in Vietnam and the

colossal build-up of war materials to that end, but his impact on the

World Bank and its lending program. He made it an agent of a global

empire, on a scale never before witnessed. He also bridged the gaps

between the primary components of corporate America, and its links with

the United States Treasury and Defense Department. The list of those

senior officials in the U.S. Government who continued the McNamara

policy in the State Department, in the CIA, in ambassadorial posts, and

in the White House, include names like George Schultz, William Casey,

Richard Helms, James Baker, Caspar Weinberger, Donald Rumsfeld, Dick

Cheyney, and George Bush himself. One can detect a ‘Texan’ thread

running through most of these men and the corporations they served,

mostly petroleum companies, or military-industrial businesses.

Robert MacNamara. After a career in

automobile manufacturing and sales, he was the logistic brain behind the

Vietnam War. President Johnson then made him head of the World Bank.

Some believe he made that organization a tool of U.S. capitalism and

imperialism.

A respected senior

economist has written : “The 1970’s had been the heyday of the ‘big

project’ paradigm for economic development. Officials from Institutions

like the World Bank, the Inter-American Development Bank, the Asian

development Bank, and the U.S. Agency for International Development,

roamed the globe, making huge project loans and preaching the virtues of

sophisticated development-planning techniques. … By 1990, developing

countries had accumulated more than $ 1.3 trillion in foreign debt. … In

2000, eighty-six percent of the US EXIM’s bank $ 7.7 billion in new

foreign export credits and guarantees went to just ten politically

influential U.S. companies, including Halliburton, Enron, General

Electric, Boeing, Bechtel, United Technologies, Schlumberger, and

Raytheon.” [

James S. Henry, The Blood Bankers, Tales from the global Undergound

Economy, New York, 4 Walls, 2003.]

The other side of the

exploitation story is that many of the countries targeted by the

multi-nationals, have repressive, corrupt governments, and some have

ongoing internal armed conflicts. A corrupt government is a gift to a

foreign corporation intent on seducing them to sign up to large loans

that are to be spent on huge contracts to the same corporations. This

is sometimes referred to as “the resource curse”. One thinks of

countries like Nigeria, Indonesia, Angola, and some South American and

Arabian states in that respect. They have each paid a heavy price for

accepting the “Danegeld” of the petroleum corporations and the

World Bank. There has been an attempt in recent years to counter the

practice by the introduction of a degree of transparency. A campaign, “Publish

What You Pay”, was launched in 2002 to persuade oil and mining

companies to disclose all payments made to individual countries. The

campaign got scant support from the US Government.

A second effort, the “Extractive

Industries Transparency Initiative”, attempted to get the

governments involved to follow a transparency code in their dealings.

Such attempts to address the resource curse, and have civil society

pressure companies and governments, face new obstacles as China and

India join the hunt for fresh resources to feed their rapidly growing

industries and cities.

Even if one argues that

the above is not the whole picture, and that some global lending has

done good, I have deep skepticism about the ability of the world’s

financial bodies to solve the problem of global p overty. As

Schumacher said in 1973, about the use of very sophisticated technology

to put the world’s unemployed to work, - “It is like trying to cast

out demons by Beelzebub the prince of demons”. The interventions

of major banks more often than not add to the problems rather than

solving them. For a start, the mention of their huge amounts of

finance, attracts a host of corrupt politicians and officials, like

flies to a honey pot. And these corrupt persons are not found only in

the developing countries, they are around in western democracies, and in

the cloisters of the United Nations.

Poverty in old

London Poverty in rural USA during the Depression

No, despite all the

efforts of the World Bank and the major donors, poverty increases. In

2002 according to UN statistics; 1.2 billion people live on less than a

dollar a day; 2.8 on less than 2 dollars a day; over a billion lack

access to clean water; 827 million suffer from malnutrition. And all

this time, the income of the richest one per cent of the world is equal

to the total income of more than half the world (57% to be exact).

Total international aid represents only 0.18 % of global GDP. That is

less than one fifth of one per cent. Meantime one hears foolish

statements about ending poverty. They remind me of a pathetically

funded and even more pathetically implemented UN programme to end all

poverty in Africa, initiated in the late 1980’s. I sat in a meeting

with Food and Agriculture ‘experts’ where one actually said “If this

project ends all poverty, there will be nothing for us to do in the next

decade (the 90’s). A colleague sitting by responded that, “well,

I think we should not assume that all poverty will be eliminated. There

will still be some work to do after the programme is over”. One

wondered what planet they were living on. 7 years later FAO had reduced

its goal to only halving hunger by 2015. By 2006 it admitted that

virtually no progress had been made in eradicating hunger.

Global hunger and poverty

Similarly when Tony

Blair and Gordon Brown spoke of ending poverty in Africa, having worked

in 16 African states, I had to shake my head. Not at the attempt or its

well-meaning goal, - but at the thought that a country of 60 million

persons could actually remove all poverty from the huge

drought-afflicted, aids-stricken, and corruption-ridden continent. New

Labour can scarcely make a dent in the poverty of Glasgow’s worst

housing estates, or Edinburgh’s districts of Pilton, Niddrie or Wester

Hailes. It cannot end poverty in Brent, in London city. How then can

it do so in all of Africa ? No, one suspects these altruistic

statements are for domestic political consumption. Some may complain

when I pour cold water on a genuine move in the right direction. I

welcomed the move. I wished it were greater. I wished it all success.

I am delighted that there is now a commitment to cancel crippling debt.

But let’s not delude ourselves about the likely outcome of the best that

one country could do. The rich man’s club that we call the European

Union, and the United States of America, both need to dismantle and

abolish the trade barriers they have erected to protect their markets

from the produce of poor countries, and spend a great deal less on arms

and more on practical assistance.

Of the recent world

leaders, President Bill Clinton appears to have the best record of

practical assistance to the world’s poor and disadvantaged, both when in

office, and since leaving it. Together with the musician Bono of U 2,

and philanthropists like Tom Farmer of Scotland, Bill Clinton has

organised and orchestrated possibly the largest amount of private

assistance ever, for the destitute and aids-stricken poor of Africa.

|

Poverty in

London

Sleeping rough

in London

The borough of

Brent in London is one of the two boroughs in UK that has a

larger population of Blacks and Asians than it does of Whites.

Out of a total population of 263,000 persons, 46 % are black or

Asian, 29 % UK white, and 21 % Chinese and non-UK white. Of the

200,000 who are of an age to be working, nearly 70,000 are

economically inactive. Some 50,000 of the population have no

educational or technical / vocational qualifications. Over

31,600 households have no adult in employment, and 32,400 have

at least one family member with a long term illness. The

borough sees over 30,000 crimes a year, mostly forms of robbery,

some with violence. The area is also vibrant with a huge range

of social programmes and social activities. Economically it

lags well behind most of the United Kingdom, and is illustrative

of the fact that an affluent modern society like Britain still

struggles to provide employment and good living conditions and

services for all of its peoples, as does the USA for its mainly

black poor population in the Gulf states and in the urban

ghettos of its large cities. There is serious poverty even in

London and in Washington DC. |

Sixto Roxas, (SKR to

his friends), a Filipino economist and former banker I knew in the

1980’s, has worked for years assisting poor peasants, like the sugar

estate workers of the island of Negros, and has some interesting things

to suggest for alternative economic systems. He says, “The world we

are living in today is being cunningly and insidiously organised to fall

into a particular pattern of imposed development, a massive

restructuring in the image of the enterprise system’, that only

engages itself in projects that are profitable to the promoters, and

which ignores humanity’s other needs. “What is left behind is a

gigantic mess of virtually unsolvable problems: health, education,

environmental preservation, care for the poor and the handicapped”.

Today, at 79 years of age, Roxas continues his imaginative efforts

to achieve meaningful and beneficial models of agrarian reform.

People are reduced to

flesh-and-blood machines that earn wages and salaries and generate

profits for the investors, but whose non-economic existence is not

recognized. Roxas proposes that a profit-and-loss balance sheet be

drawn up for the community as a whole rather than for just the income

earners in its area. “The enterprise paradigm has established an

accounting system that measures revenues, costs and incomes for

enterprise owners. A new community paradigm must do the same for

communities”, he says, adding that national income figures such as

GDP, ought to be compiled from community accounts rather than, as at

present, from the incomes of firms and individuals which say little

about the real growth in and distribution of the nation’s wealth.

Attempts to institute

such radical schemes of social accounting and cooperative sharing of

benefits in cash and in kind, have been around since the early days of

the cooperative movement. They rarely thrive beyond a certain level

because they have to exist in a sea of capitalist businesses and

monetary structures that ignore, isolate or reject them, as if they were

foreign bodies inside a living organism. Nevertheless, some still exist

today and a few continue to flourish. Two continuing examples would be

the Kibbutzim of Israel, and the Amish communities of North America. It

is not surprising that both these remarkable socio-economic systems are

maintained by persons of strong religious faith and ethnic identity, as

such communes require a degree of commitment beyond normal employer –

employee relationships. They are not an easy option, neither are they a

cosy haven for

individuals who have no desire to work.

Some more recently

established community-cooperative type enterprises include the

Schumacher-promoted common ownership common-wealth ventures like

Scott-Baader, in the 1970’s, and others in France and West Africa; the

Sustainable Seattle project, and the Briarpatch craft guilds of San

Francisco. Other similar bodies, including work-sharing non-money based

groups, have been set up in Britain and Europe. Some have succeeded,

and some have lasted for a short period only. A number of small but

remarkably successful ‘local currency’ groups have flourished in the

USA, initiated by the E. F. Schumacher Society of Great Barrington,

Massachusetts and similar non-profit bodies. One of the most innovative

and locally successful was SHARE (Self-Help Association for a Regional

Economy) established in 1982. It claims to “put a human scale and a

human touch back into local economic transactions”. It boasts a 100 %

return on loans, and has been able to provide credit to establish family

farms, cheese making businesses, deli food stores, corn markets and

sweater knitwear units.

Ideas on how to bring

millions of financially deprived persons into the modern economic system

have recently focused on recognition of the meager financial asset they

possess in their mud huts, bamboo houses and shanty town shacks. Few of

the world’s poor have legal title to their homes. For many the

miserable properties are rented. Others are erected on land owned or

controlled by the state or the wealthy private sector. What economists

say in effect, is that though these tiny houses are worth only a few

hundred dollars at most, - there are so many of them, - hundreds of

millions, - that their combined monetary value must amount to tens or

even hundreds of billions of dollars. If the poor squatters or slum

dwellers could become bankable entities by having title to their

miniscule assets, then there would be no need for foreign aid or

assistance. They could all then have the possibility to mortgage their

homes and go into business at a micro-level.

This imaginative

philosophy is expounded by the renowned Peruvian banker and economist,

Hernando de Soto, in his book, The Mystery of Capital. De Soto

is the founder of the ILD, the Institute for Liberty and Democracy in

Lima. His radical proposal was referred to by former President

Clinton in his BBC lecture in London. I strongly suspect that the

capitalists who hail this idea as the solution, have little practical

experience of working with poor and destitute. I also suspect that it

gives them an excuse for non-action, for if true, then it is the fault

of the poor that they are in their predicament. It smacks of the

suggestion that the poor are to blame themselves for their predicament,

and the capitalists’idea that the poor can be blessed by the ‘trickle

down’ effect if they (the rich) would just go ahead and become richer by

making their enterprises more profitable.

What proponents of the

capitalization of the assets of the poor do not ask or say, is, - who

will be the main beneficiary of a de Soto measure ? The answer to that

question must be the banks and financial institutions of the world. The

lending banks would stand to make millions of dollars in profits off the

capitalization of the assets of the poor. Something about the whole

scheme fills me with unease. With their tiny amounts of cash, the poor

would then be working, not only to survive and feed their families, but

also to generate profits for the banks. And if they failed, - what

would happen to their assets? Presumably they would be repossessed.

Even under ancient harsh religious laws, lenders had to return cloaks or

blankets given as collateral, to the borrower each evening, so he would

not die of exposure.

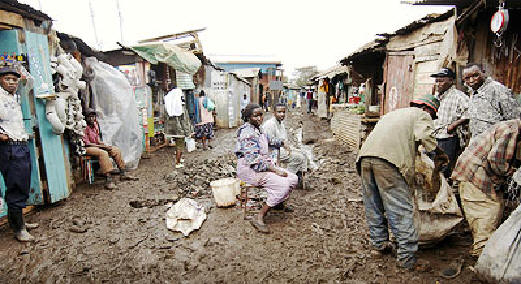

Rural poverty

Urban squalor

The experience of the

Grameen Bank in Bangladesh, established by Muhammad Yunus in 1976 has

shown that the poorest of the poor can be surprisingly honest and

faithful in repaying debts. That remarkable bank has experienced rates

of loan repayment that commercial banks can only dream of. It has grown

from lending of $ 27 to 42 persons in 1976, to

$ 2.3

billion lent in total by 1998. Currently the bank has over 2 million

borrowers. Average loans are still less than $ 100 or £ 50

each.

Interestingly Yunus has regularly rejected World Bank offers of large

low-interest loans, for reasons similar to why Mother Theresa would not

accept offers of money for her mission from the Indian Government. Both

offers came with strings attached that would in effect change the

character and philosophy of the core organization. Yunus’s work with

the Grameen Bank was finally given international recognition in October

2006 when he received the Nobel Peace Prize.

The Grameen Bank at work, lending to the

poorest of the poor

Having assisted with numerous credit schemes to help the

rural poor, from a Freedom From Hunger revolving fund in Africa in the

early 1960’s, to multi-million dollar schemes financed by the

international development banks, I feel a bit like a pharmacist friend

who used to say that there was nothing like a lifetime dispensing

medicines to disillusion one completely from any faith whatsoever in

drugs and potions ! Or to use a very different illustration, I recall a

young Pat Kelly-Rogers on the deck of a herring trawler I skippered in

the days before mechanical aids were available to lift, wash and select

fish on deck. Pat was bent over, scooping up small, haddock, mackerel

and herring from a 5 ton haul, and laboriously selecting them into

separate baskets for the different species. He straightened up after a

while, stretched his aching back, and looking up to me on the bridge,

said. – “There’s got to be a better way” !.

Founder of the Grameen Bank, and Nobel

Prize winner, Muhammad Yunus

The Indian government had him pushed of

the board of the bank he founed when he turned 70. Even banks

established to help the poor attract avaricious financial interest. Mrs

Thatcher and her friends in the city of London did the same with the

Trustee Savings Bank (formerly the Aberdeen Savings Bank which by its

very constitution was “owned by its depositors”. ).

Well, there has to be a

better way to reduce poverty and to improve the earnings and

productivity of the world’s poor. I do not believe it will be possible

by urging them to follow the western path to industrialization and

affluence. There is no way everyone in the world will be able to

consume energy and raw materials at the levels of the populations of the

USA, Europe and Japan. The resources simply do not exist to supply all

humanity with enough to emulate our excessive consumption patterns. The

world’s population will never be able to consume meat protein or

petroleum fuel at the levels of the industrialized societies. In any

case, the era of fossil fuels is coming to a close within the 21st

century, and there will soon be severe global shortages of fresh water.

So a very different route needs to be found to achieve universal access

to basic food, water, health and housing provisions.

Certainly, the poor

have to become more productive, and more efficient. There has to be an

economic motor to create more wealth and drive the small-scale

enterprise society. But the technology and systems that will benefit

the billions of subsistence farmers or fishers, and the unemployed, or

underemployed persons, will have to be appropriate to the smaller scale

and lower cost structures of that half of the world’s population. They

cannot all work in Nike shoe factories producing expensive goods for the

affluent. Petroleum- based energy systems must begin to decline within

the next 20 years or else we are in really serious trouble. So the

machinery and motors developed for small-scale systems in the third

world will have to be low-cost and to utilize renewable fuels or natural

energy. And the West should avoid the hypocritical advice to developing

countries to ‘curb their appetites’. It is like a glutton telling a

beggar to exercise self-control.

|

Radical

thinkers

We desperately

need imaginative minds that can see how to move from our current

stalemate and paucity of thought on tackling the social and

economic dilemmas of our day. All my life I have quizzed

development officers, politicians, and academics, on the best

way forward. Sadly, many of them had little helpful advice, and

were bereft of ideas beyond the stale, failed policies of the

past. If we had invested a fraction of the money we have put

into military arsenals, into health services and renewable

energy systems, the world would be enormously better for it

today. Similarly, if we had put much more practical research

and imaginative thought into beneficial economic and social

innovations, and studied in-depth what was actually happening as

a result of current and past efforts, we might be much nearer

satisfactory solutions than we are now. Too often we zero in on

“improving” the efficiency of systems that are never going to

work.

There are few

remarkable persons in my own experience, who addressed these

issues with imagination, understanding, and professionalism. I

mentioned some already in previous chapters. Here I would like

to pay tribute to three: Roger Mullin of Scotland, Menachem Ben

Yami of Israel, and Dr John Kurien of India.

All three have

been enormously helpful to me, and it has been a privilege to

serve alongside them. I worked with Roger in Scotland, Rome

Italy, Vienna Austria, the Marshall Islands, and Namibia. Menachem

and I were colleagues in FAO, and participants in numerous

seminars, conferences, and think-tanks. John Kurien was an

esteemed consultant in ADB and FAO meetings and projects in SE

Asia and Indo-China. He is also the visionary founder of ICSF

the international collective for small-scale fishery workers.

All three have written imaginative and ground-breaking papers on

aspects of development.

Roger Mullin of Scotland,

education, management, and social structures consultant, who

worked alongside me in Britain, Ireland, Rome Italy, Vienna

Austria, the Marshall Islands, and Namibia.

Three radicals: Menachem Ben

Yami, John Kurien, and myself. |

As long as we continue

to spend a hundred times more on armed forces and weapons of war than we

do on global assistance to the poor, we should not deceive ourselves

into thinking that we can solve the problems of world hunger and

poverty. We need to beat our swords into ploughshares and our spears

into pruning hooks. But just imagine if the leading powers were to

unite in a massive effort to conserve soil and water, to re-plant

forests and to reverse the pollution of air, land, and sea, - and to do

it in a way that would provide millions with remunerative work, - just

imagine the difference it would make to the major environmental and

social problems of the world. And let us remember that in protecting,

conserving and enhancing the environment, we are preserving our own

life-support system, and that of our children, and our children’s

children. And in addressing the social evils we are protecting

ourselves and our children from the conflicts that continued social

unrest would lead to, whether in the form of war or of terrorism.

If we are serious about

tackling global poverty, malnutrition and human degradation, we have to

end the destruction of tropical and sub-tropical forests, we must ensure

that global fresh water resources are conserved, and that all peoples,

however poor, have access to clean drinking water. We will have to

reverse the growing desertification in Africa and Asia. Every person

should have the opportunity to work with dignity, whether income-earning

in an activity of their own, or as paid employees. Access to land,

water, and to local natural resources must be equitably administered,

and not be the sole preserve of the wealthy and powerful, whether

individuals or corporations.

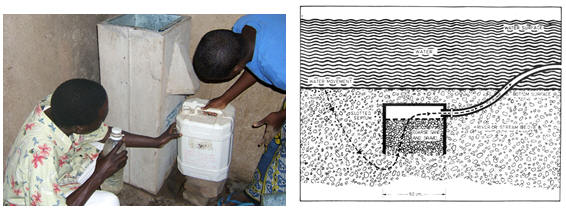

Simple drinking water supply units. This

is possibly the greatest need of the world’s poor, few of whom have

access to safe drinking water. Diagram of Cansdale filters and

pumps. They are specifically designed to be low-cost and to be easily

maintained by poor communities.

George Cansdale demonstrating water

filtration

Two enormous changes

are essential if this is to happen : Corrupt, despotic regimes must go.

- And global capitalism must take its jackboot off the necks of the

people. I’ll give two examples. Poor countries should be allowed to

produce low-cost local drugs to treat aids, tuberculosis and malaria.

Wealthy pharmaceutical corporations should forego patent rights in these

circumstances. Secondly, a way must be found to deliver small amounts of

low-cost credit to poor farmers, artisans, and peasant traders. At

present, the World Bank or ADB can give a country a loan at 1, 2 or 3

per cent, with a five year grace period. But no third world government

will allow its poor people to access funds at that rate. The government

and the national banks all take a cut, and eventually the impoverished

peasant has to pay anything from 14% to over 20%, with no grace period.

This is no exaggeration. I see it time and time again, all over the

world. There must be a difference in approach to lending to

impoverished peoples for their food security and economic survival, and

lending to a powerful wealthy corporation that will make huge profits.

Referring back to my

two essential changes; - they reflect two different attitudes towards

third world development. The provision of aid is what is commonly seen

as the obvious way to help people out of poverty. Examples of this

approach (however flawed), include bilateral aid from rich states,

multi-lateral aid from the U.N. or the World Bank, and all the

assistance provided by charities and non-government organizations. The

other approach is to target the corrupt regimes and to have them

replaced somehow with democratic and responsive governments. This is

the approach trumpeted by the United States (except that the only

regimes it seems to overthrow are ones with oil resources, or those that

pose a particular threat to American business). For others who do not

possess oil reserves, the ‘freedom and democracy’ argument is used as an

excuse for not giving direct aid. Where intervention has occurred, as

in Haiti and Iraq and Afghanistan, we can ask ourselves, - have these

states really become democratic entities?

I personally favour

by-passing the despotic administrations, and providing practical

assistance direct to the most needy. This is best done through the

charities, the missions, the NGOs like OXFAM, Tearfund, and ITG, and

through concerned individuals. Local production of cheap drugs is

something that even corrupt rulers would have difficulty in opposing.

And through cheap modern communications, information can reach the most

remote village, raising people’s awareness of issues. Corruption

flourishes when it can be hidden or obscured, but will eventually be

shamed out of existence when it comes under the glare of public

knowledge. If a state like North Korea or Myanmar, or Sudan, resists

efforts to free or assist its people, then so be it. But they should be

subjected to the maximum global exposure of their crimes against their

own humankind.

But there is another

aspect to poverty we need to consider. There are countries and areas of

the world that are poor in a statistical sense, judged by cash income or

GDP per head. Yet they may live comfortably and in a measure of

contentment, in an environment that is pleasant and conducive to good

quality of life. There are other communities and regions that may have

a higher per capita income, in states where oil wealth has inflated the

GNP statistically, yet the people live in squalor and under threat from

exploitation, crime, disease, and limited access to medical services and

schools. Readers would no doubt agree that if they had to be poor, they

would rather be poor on a Pacific island, or in Cuba, or in a mountain

farming community in Africa or South America, - than in a back street

slum in Lagos or Mumbai, Buenos Aires, Rio de Janiero, or Jakarta.

Mother Theresa spoke eloquently of the other side of poverty, - and this

extends to spiritual poverty among the world’s affluent. She said there

were people who were:

“hungry,

not just for bread, but for love. Naked, not only for lack of clothing,

but naked of human dignity and respect. Homeless, not only for want of

of a room of bricks, - but homeless because of rejection”.

|